Summary

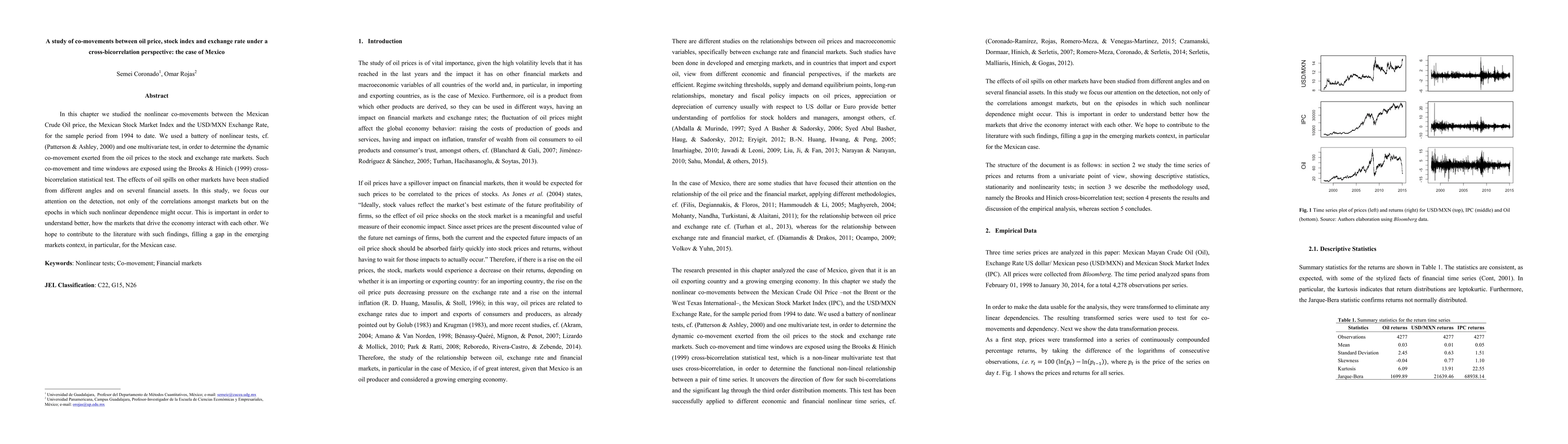

In this chapter we studied the nonlinear co-movements between the Mexican Crude Oil price, the Mexican Stock Market Index and the USD/MXN Exchange Rate, for the sample period from 1994 to date. We used a battery of nonlinear tests, cf. (Patterson & Ashley, 2000) and one multivariate test, in order to determine the dynamic co-movement exerted from the oil prices to the stock and exchange rate markets. Such co-movement and time windows are exposed using the Brooks & Hinich (1999) cross- bicorrelation statistical test. The effects of oil spills on other markets have been studied from different angles and on several financial assets. In this study, we focus our attention on the detection, not only of the correlations amongst markets but on the epochs in which such nonlinear dependence might occur. This is important in order to understand better, how the markets that drive the economy interact with each other. We hope to contribute to the literature with such findings, filling a gap in the emerging markets context, in particular, for the Mexican case.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)