Summary

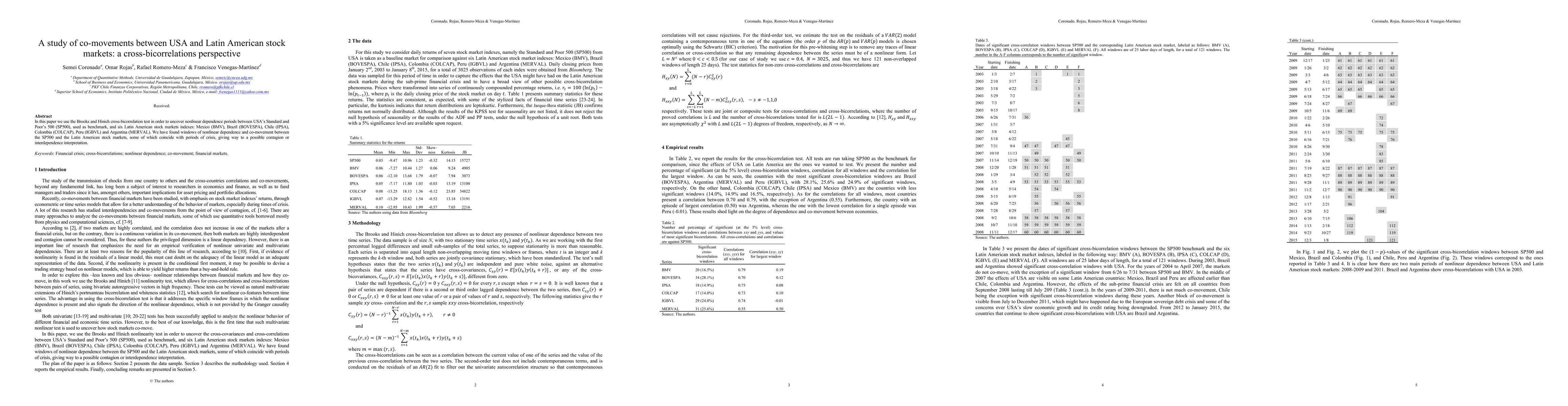

In this paper we use the Brooks and Hinich cross-bicorrelation test in order to uncover nonlinear dependence periods between USA Standard and Poor 500 (SP500), used as benchmark, and six Latin American stock markets indexes: Mexico (BMV), Brazil (BOVESPA), Chile (IPSA), Colombia (COLCAP), Peru (IGBVL) and Argentina (MERVAL). We have found windows of nonlinear dependence and co-movement between the SP500 and the Latin American stock markets, some of which coincide with periods of crisis, giving way to a possible contagion or interdependence interpretation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)