Summary

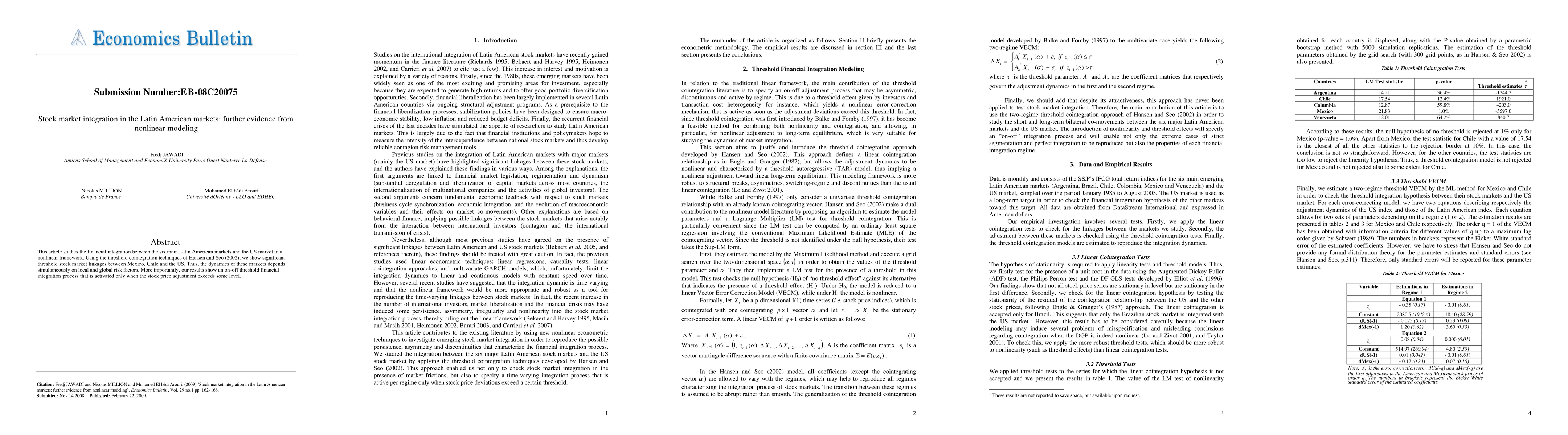

This article studies the financial integration between the six main Latin American markets and the US market in a nonlinear framework. Using the threshold cointegration techniques of Hansen and Seo (2002), we show significant threshold stock market linkages between Mexico, Chile and the US. Thus, the dynamics of these markets depends simultaneously on local and global risk factors. More importantly, our results show an on-off threshold financial integration process that is activated only when the stock price adjustment exceeds some level.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)