Authors

Summary

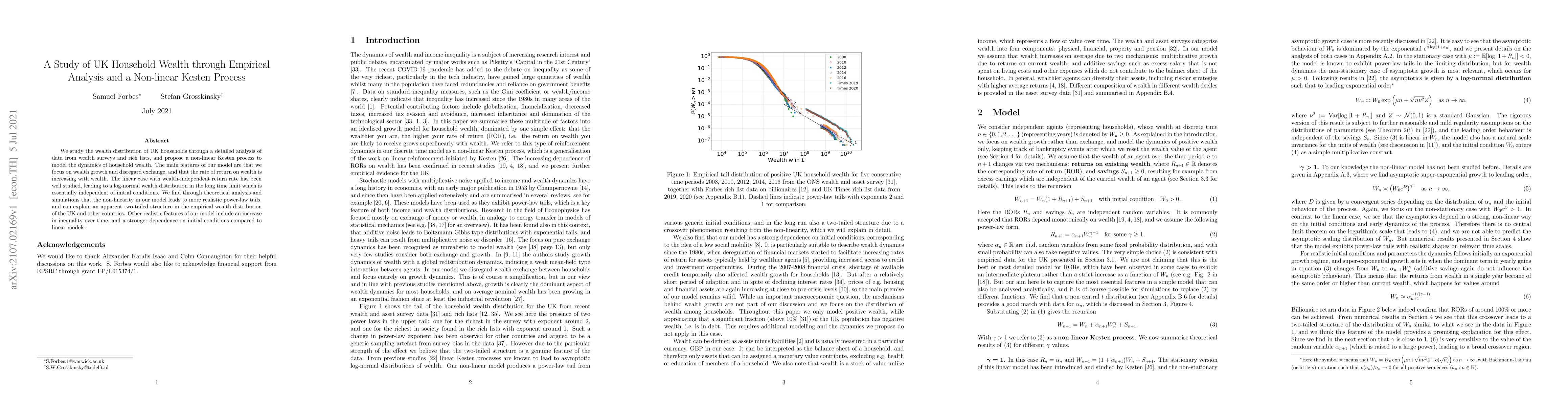

We study the wealth distribution of UK households through a detailed analysis of data from wealth surveys and rich lists, and propose a non-linear Kesten process to model the dynamics of household wealth. The main features of our model are that we focus on wealth growth and disregard exchange, and that the rate of return on wealth is increasing with wealth. The linear case with wealth-independent return rate has been well studied, leading to a log-normal wealth distribution in the long time limit which is essentially independent of initial conditions. We find through theoretical analysis and simulations that the non-linearity in our model leads to more realistic power-law tails, and can explain an apparent two-tailed structure in the empirical wealth distribution of the UK and other countries. Other realistic features of our model include an increase in inequality over time, and a stronger dependence on initial conditions compared to linear models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)