Summary

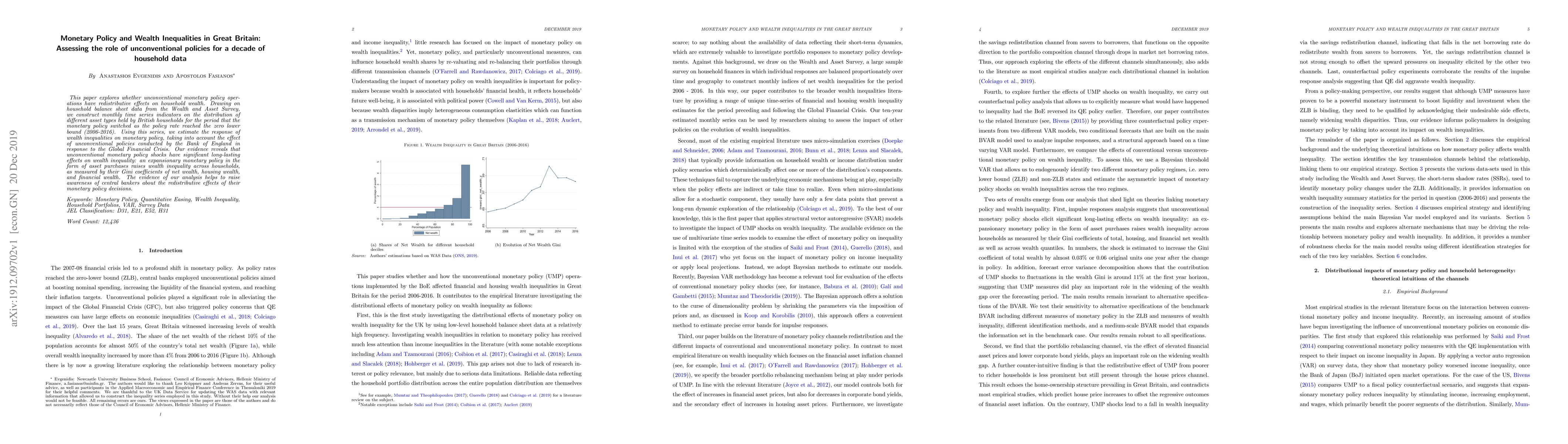

This paper explores whether unconventional monetary policy operations have redistributive effects on household wealth. Drawing on household balance sheet data from the Wealth and Asset Survey, we construct monthly time series indicators on the distribution of different asset types held by British households for the period that the monetary policy switched as the policy rate reached the zero lower bound (2006-2016). Using this series, we estimate the response of wealth inequalities on monetary policy, taking into account the effect of unconventional policies conducted by the Bank of England in response to the Global Financial Crisis. Our evidence reveals that unconventional monetary policy shocks have significant long-lasting effects on wealth inequality: an expansionary monetary policy in the form of asset purchases raises wealth inequality across households, as measured by their Gini coefficients of net wealth, housing wealth, and financial wealth. The evidence of our analysis helps to raise awareness of central bankers about the redistributive effects of their monetary policy decisions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMonetary policy and the joint distribution of income and wealth: The heterogeneous case of the euro area

Anna Stelzer

Testing the effectiveness of unconventional monetary policy in Japan and the United States

Sophocles Mavroeidis, Daisuke Ikeda, Shangshang Li et al.

Datasets of Great Britain Primary Substations Integrated with Household Heating Information

Chaimaa Essayeh, Thomas Morstyn, Yihong Zhou

Monetary policy and the racial wage gap

Ram Sewak Dubey, Eric Olson, Edmond Berisha

| Title | Authors | Year | Actions |

|---|

Comments (0)