Authors

Summary

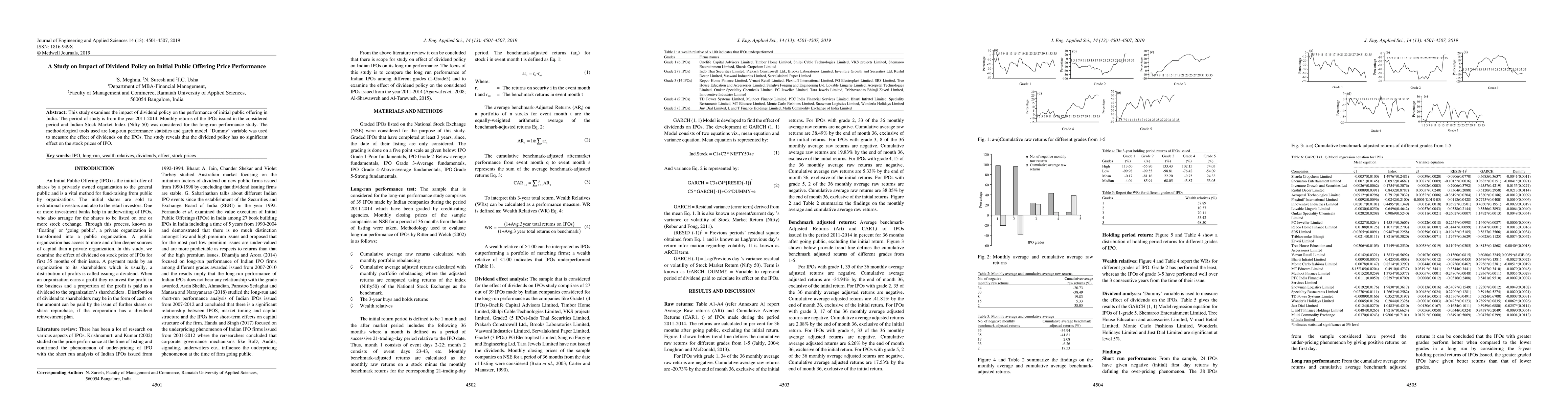

This study examines the impact of dividend policy on the performance of initial public offerings in India. The period of study is from the year 2011-2014. Monthly returns of the IPOs issued in the considered period and the Indian Stock Market Index (Nifty 50) were considered for the long-run performance study. The methodological tools used are long-run performance statistics and the GARCH model. The Dummy variable was used to measure the effect of dividends on the IPOs. The study reveals that the dividend policy has no significant effect on the stock prices of IPO.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)