Summary

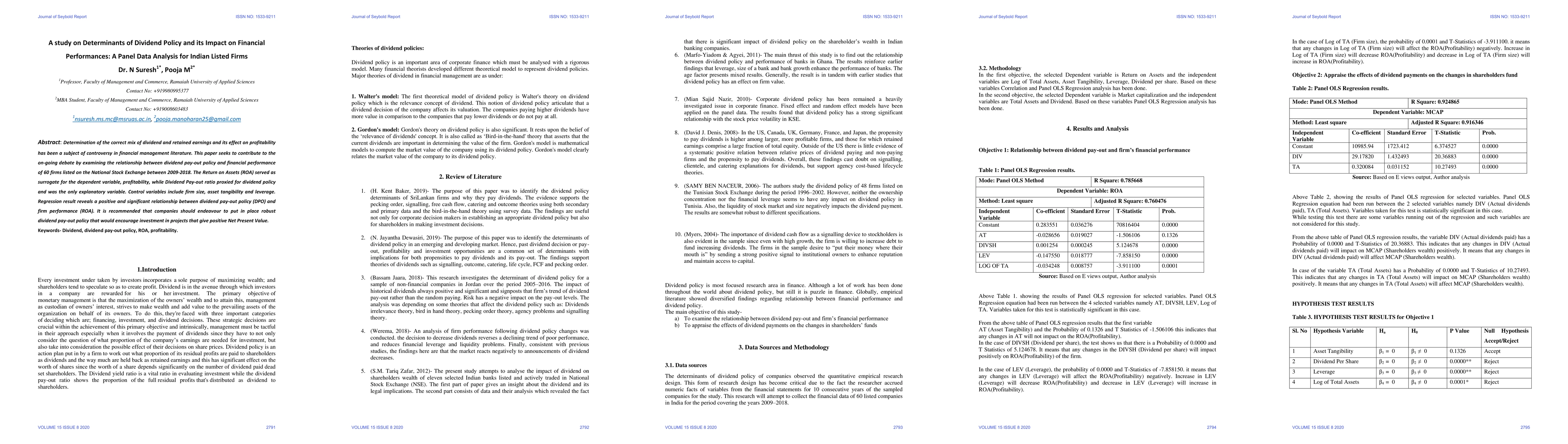

Determination of the correct mix of dividend and retained earnings and its effect on profitability has been a subject of controversy in financial management literature. This paper seeks to contribute to the ongoing debate by examining the relationship between dividend payout policy and the financial performance of 60 firms listed on the National Stock Exchange between 2009-2018. The Return on Assets (ROA) served as a surrogate for the dependent variable, profitability, while the Dividend Pay-out ratio proxied for dividend policy and was the only explanatory variable. Control variables include firm size, asset tangibility, and leverage. Regression result reveals a positive and significant relationship between dividend payout policy (DPO) and firm performance (ROA). It is recommended that companies should endeavor to put in place a robust dividend payout policy that would encourage investment in projects that give positive Net Present Value.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Study on Impact of Dividend Policy on Initial Public Offering Price Performance

N. Suresh, S. Meghna, J. C. Usha

| Title | Authors | Year | Actions |

|---|

Comments (0)