Summary

The prediction of stock and foreign exchange (Forex) had always been a hot and profitable area of study. Deep learning application had proven to yields better accuracy and return in the field of financial prediction and forecasting. In this survey we selected papers from the DBLP database for comparison and analysis. We classified papers according to different deep learning methods, which included: Convolutional neural network (CNN), Long Short-Term Memory (LSTM), Deep neural network (DNN), Recurrent Neural Network (RNN), Reinforcement Learning, and other deep learning methods such as HAN, NLP, and Wavenet. Furthermore, this paper reviewed the dataset, variable, model, and results of each article. The survey presented the results through the most used performance metrics: RMSE, MAPE, MAE, MSE, accuracy, Sharpe ratio, and return rate. We identified that recent models that combined LSTM with other methods, for example, DNN, are widely researched. Reinforcement learning and other deep learning method yielded great returns and performances. We conclude that in recent years the trend of using deep-learning based method for financial modeling is exponentially rising.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

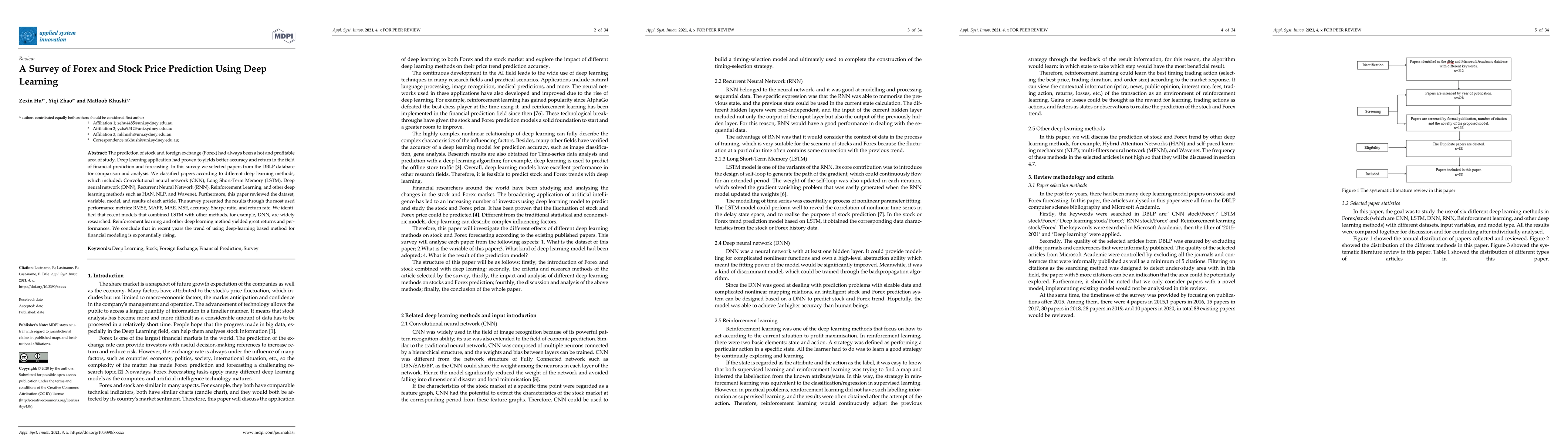

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)