Authors

Summary

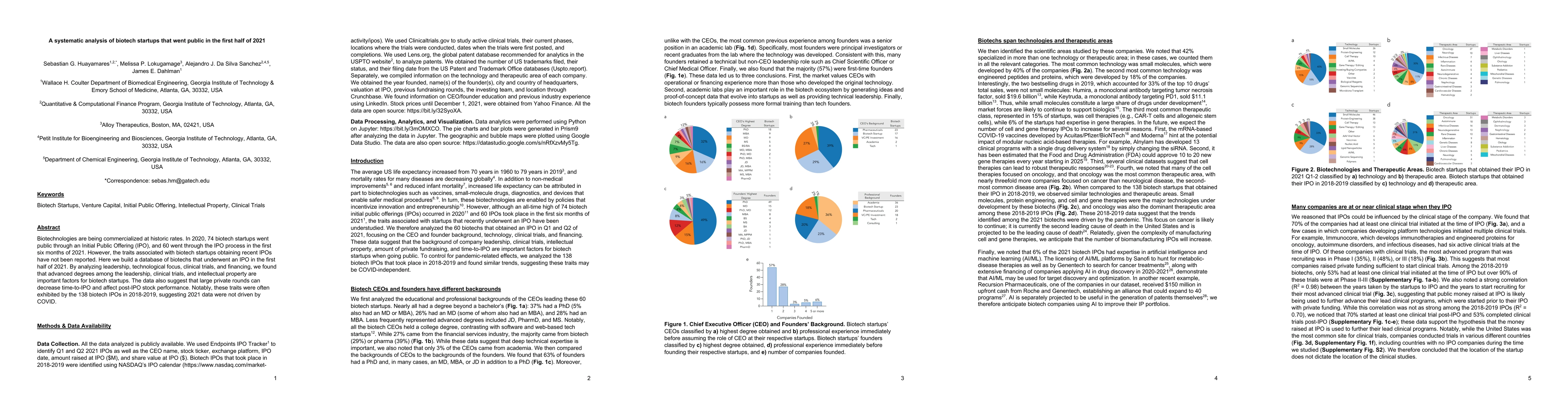

Biotechnologies are being commercialized at historic rates. In 2020, 74 biotech startups went public through an Initial Public Offering (IPO), and 60 went through the IPO process in the first six months of 2021. However, the traits associated with biotech startups obtaining recent IPOs have not been reported. Here we build a database of biotechs that underwent an IPO in the first half of 2021. By analyzing leadership, technological focus, clinical trials, and financing, we found that advanced degrees among the leadership, clinical trials, and intellectual property are important factors for biotech startups. The data also suggest that large private rounds can decrease time-to-IPO and affect post-IPO stock performance. Notably, these traits were often exhibited by the 138 biotech IPOs in 2018-2019, suggesting 2021 data were not driven by COVID.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalysis of Software Engineering Practices in General Software and Machine Learning Startups

Nasir U. Eisty, Bishal Lakha, Kalyan Bhetwal

| Title | Authors | Year | Actions |

|---|

Comments (0)