Summary

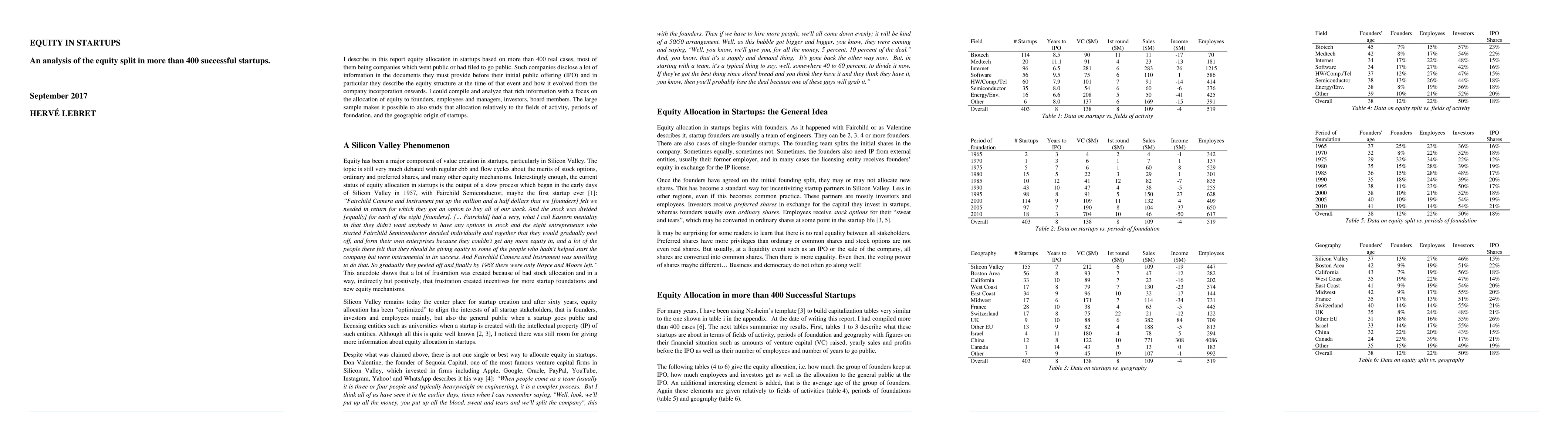

Startups have become in less than 50 years a major component of innovation and economic growth. An important feature of the startup phenomenon has been the wealth created through equity in startups to all stakeholders. These include the startup founders, the investors, and also the employees through the stock-option mechanism and universities through licenses of intellectual property. In the employee group, the allocation to important managers like the chief executive, vice-presidents and other officers, and independent board members is also analyzed. This report analyzes how equity was allocated in more than 400 startups, most of which had filed for an initial public offering. The author has the ambition of informing a general audience about best practice in equity split, in particular in Silicon Valley, the central place for startup innovation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersSoftware Startups -- A Research Agenda

Xiaofeng Wang, Markku Oivo, Michael Unterkalmsteiner et al.

Experimentation in Early-Stage Video Game Startups: Practices and Challenges

Jorge Melegati, Henry Edison, Elizabeth Bjarnason

No citations found for this paper.

Comments (0)