Summary

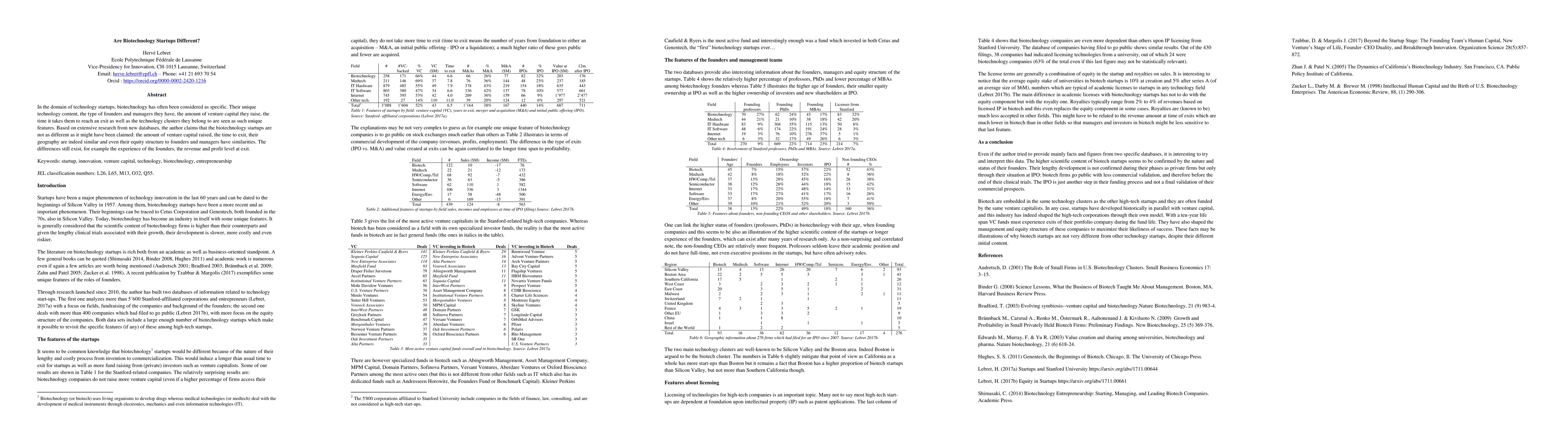

In the domain of technology startups, biotechnology has often been considered as specific. Their unique technology content, the type of founders and managers they have, the amount of venture capital they raise, the time it takes them to reach an exit as well as the technology clusters they belong to are seen as such unique features. Based on extensive research from new databases, the author claims that the biotechnology startups are not as different as it might have been claimed: the amount of venture capital raised, the time to exit, their geography are indeed similar and even their equity structure to founders and managers have similarities. The differences still exist, for example the experience of the founders, the revenue and profit level at exit.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersManaging Biotechnology and Healthcare Innovation Challenges and Opportunities for Startups and Small Companies

Erfan Mohammadi, Narges Ramezani

Research and development investments for biologics independently developed by US biotechnology startups, 2017-2023.

Kang, So-Yeon, Alexander, G Caleb, Odouard, Ilina C et al.

No citations found for this paper.

Comments (0)