Authors

Summary

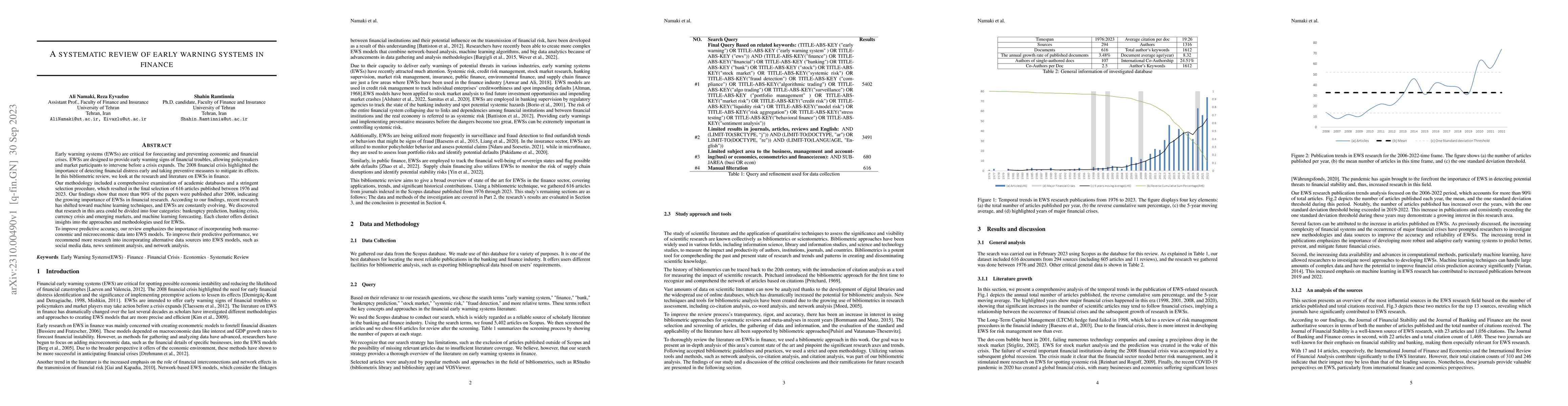

Early warning systems (EWSs) are critical for forecasting and preventing economic and financial crises. EWSs are designed to provide early warning signs of financial troubles, allowing policymakers and market participants to intervene before a crisis expands. The 2008 financial crisis highlighted the importance of detecting financial distress early and taking preventive measures to mitigate its effects. In this bibliometric review, we look at the research and literature on EWSs in finance. Our methodology included a comprehensive examination of academic databases and a stringent selection procedure, which resulted in the final selection of 616 articles published between 1976 and 2023. Our findings show that more than 90\% of the papers were published after 2006, indicating the growing importance of EWSs in financial research. According to our findings, recent research has shifted toward machine learning techniques, and EWSs are constantly evolving. We discovered that research in this area could be divided into four categories: bankruptcy prediction, banking crisis, currency crisis and emerging markets, and machine learning forecasting. Each cluster offers distinct insights into the approaches and methodologies used for EWSs. To improve predictive accuracy, our review emphasizes the importance of incorporating both macroeconomic and microeconomic data into EWS models. To improve their predictive performance, we recommend more research into incorporating alternative data sources into EWS models, such as social media data, news sentiment analysis, and network analysis.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research methodology involved a comprehensive examination of academic databases and a stringent selection procedure, resulting in the selection of 616 articles published between 1976 and 2023.

Key Results

- More than 90% of the papers were published after 2006, highlighting the growing importance of EWSs in financial research.

- Recent research has shifted towards machine learning techniques, with EWSs constantly evolving.

- Research can be categorized into four areas: bankruptcy prediction, banking crisis, currency crisis and emerging markets, and machine learning forecasting.

- Incorporating both macroeconomic and microeconomic data into EWS models is crucial for improving predictive accuracy.

- Alternative data sources like social media data, news sentiment analysis, and network analysis should be explored for enhancing EWS performance.

Significance

This systematic review emphasizes the critical role of EWSs in forecasting and preventing economic and financial crises, making it essential for policymakers and market participants.

Technical Contribution

The paper presents a bibliometric analysis of EWS research in finance, categorizing the literature and identifying key trends and methodologies.

Novelty

This research distinguishes itself by providing a systematic review of EWS literature, highlighting the shift towards machine learning techniques and emphasizing the importance of integrating diverse data sources for improved predictive accuracy.

Limitations

- The review is limited to articles available in academic databases up to 2023.

- It does not cover grey literature, policy papers, or industry reports which might offer additional insights.

Future Work

- More research should focus on developing and evaluating EWS models based on machine learning in various financial contexts.

- Creating effective EWSs for banking crises and financial stability is an important area for future research.

- Addressing data availability and quality concerns, as well as incorporating qualitative aspects into models, should be prioritized to improve EWS predictive performance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersArtificial intelligence in early warning systems for infectious disease surveillance: a systematic review.

Xie, Yang, Villanueva-Miranda, Ismael, Xiao, Guanghua

[Early warning scores: a rapid umbrella review].

Nydahl, Peter, Jeitziner, Marie-Madlen, Krotsetis, Susanne et al.

AI for Climate Finance: Agentic Retrieval and Multi-Step Reasoning for Early Warning System Investments

Markus Leippold, Chiara Colesanti Senni, Aymane Hachcham et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)