Authors

Summary

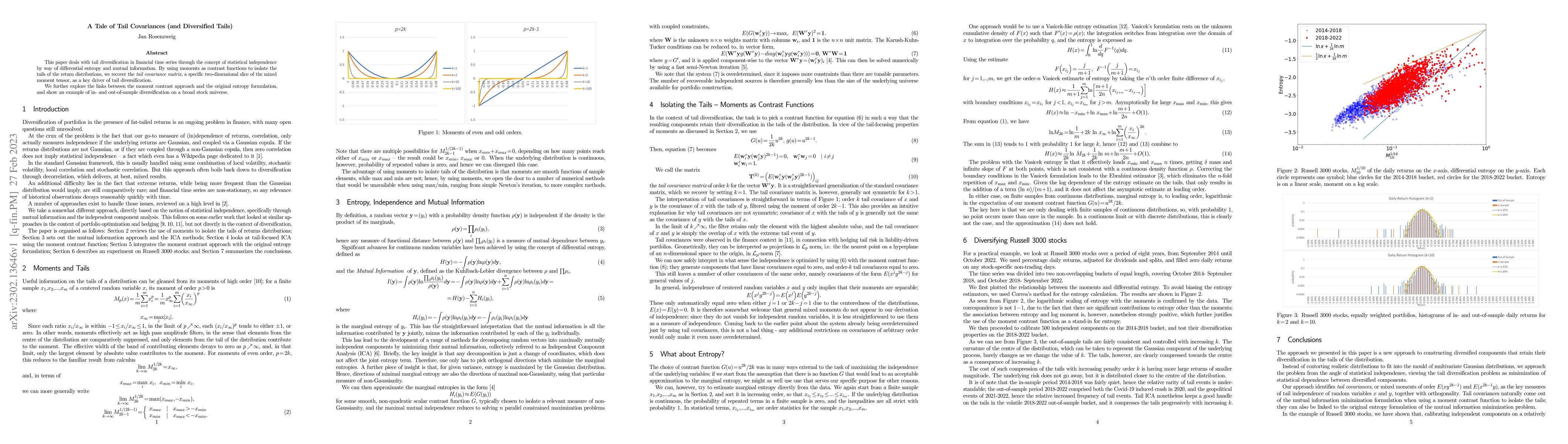

This paper deals with tail diversification in financial time series through the concept of statistical independence by way of differential entropy and mutual information. By using moments as contrast functions to isolate the tails of the return distributions, we recover the tail covariance matrix, a specific two-dimensional slice of the mixed moment tensor, as a key driver of tail diversification. We further explore the links between the moment contrast approach and the original entropy formulation, and show an example of in- and out-of-sample diversification on a broad stock universe.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTALE-teller: Tendon-Actuated Linked Element Robotic Testbed for Investigating Tail Functions

Xiaonan Huang, Zachary Brei, Talia Y. Moore et al.

No citations found for this paper.

Comments (0)