Authors

Summary

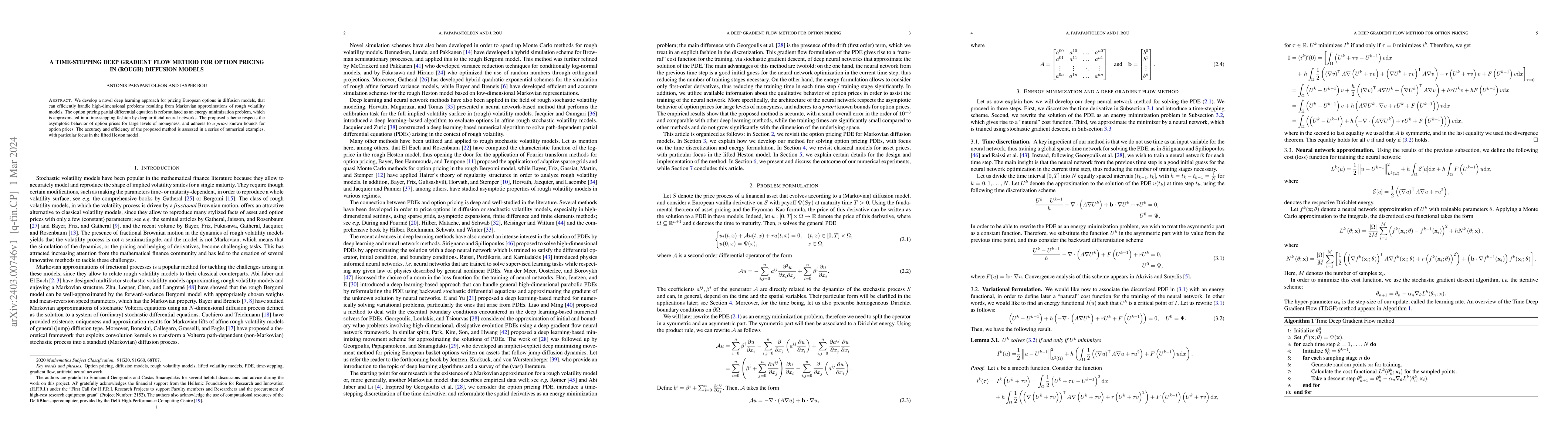

We develop a novel deep learning approach for pricing European options in diffusion models, that can efficiently handle high-dimensional problems resulting from Markovian approximations of rough volatility models. The option pricing partial differential equation is reformulated as an energy minimization problem, which is approximated in a time-stepping fashion by deep artificial neural networks. The proposed scheme respects the asymptotic behavior of option prices for large levels of moneyness, and adheres to a priori known bounds for option prices. The accuracy and efficiency of the proposed method is assessed in a series of numerical examples, with particular focus in the lifted Heston model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA deep implicit-explicit minimizing movement method for option pricing in jump-diffusion models

Antonis Papapantoleon, Emmanuil H. Georgoulis, Costas Smaragdakis

| Title | Authors | Year | Actions |

|---|

Comments (0)