Summary

Index-based hedging solutions are used to transfer the longevity risk to the capital markets. However, mismatches between the liability of the hedger and the hedging instrument cause longevity basis risk. Therefore, an appropriate two-population model to measure and assess the longevity basis risk is required. In this paper, we aim to construct a two-population mortality model to provide an effective hedge against the longevity basis risk. The reference population is modelled by using the Lee-Carter model with the renewal process and exponential jumps proposed by \"Ozen and \c{S}ahin (2020) and the dynamics of the book population are specified. The analysis based on the UK mortality data indicates that the proposed model for the reference population and the common age effect model for the book population provide a better fit compared to the other models considered in the paper. Different two-population models are used to investigate the impact of the sampling risk on the index-based hedge as well as to analyse the risk reduction regarding hedge effectiveness. The results show that the proposed model provides a significant risk reduction when mortality jumps and the sampling risk are taken into account.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

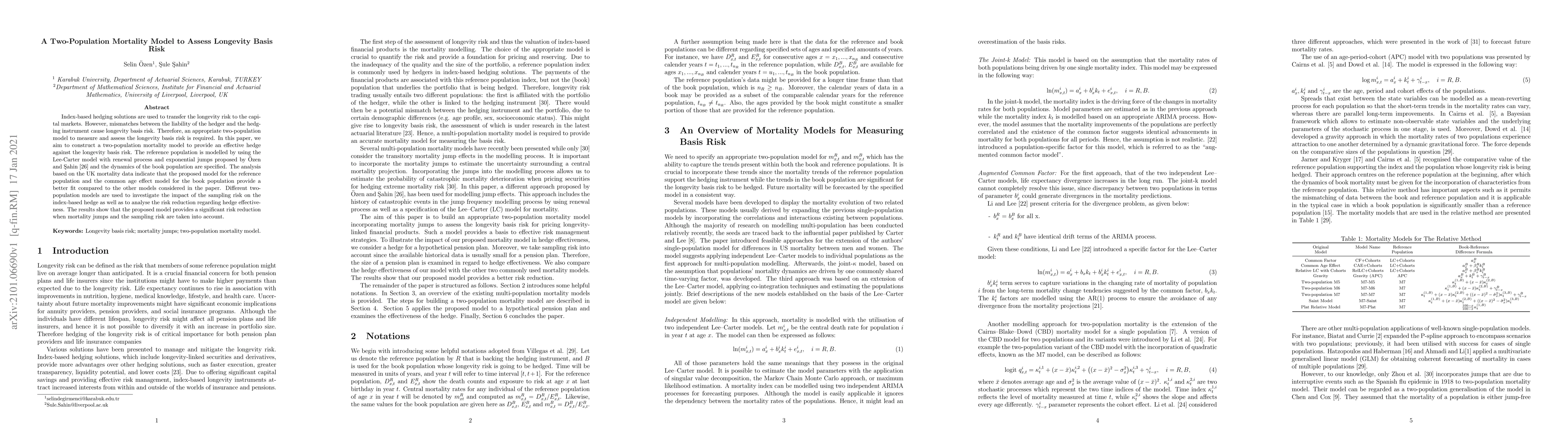

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)