Authors

Summary

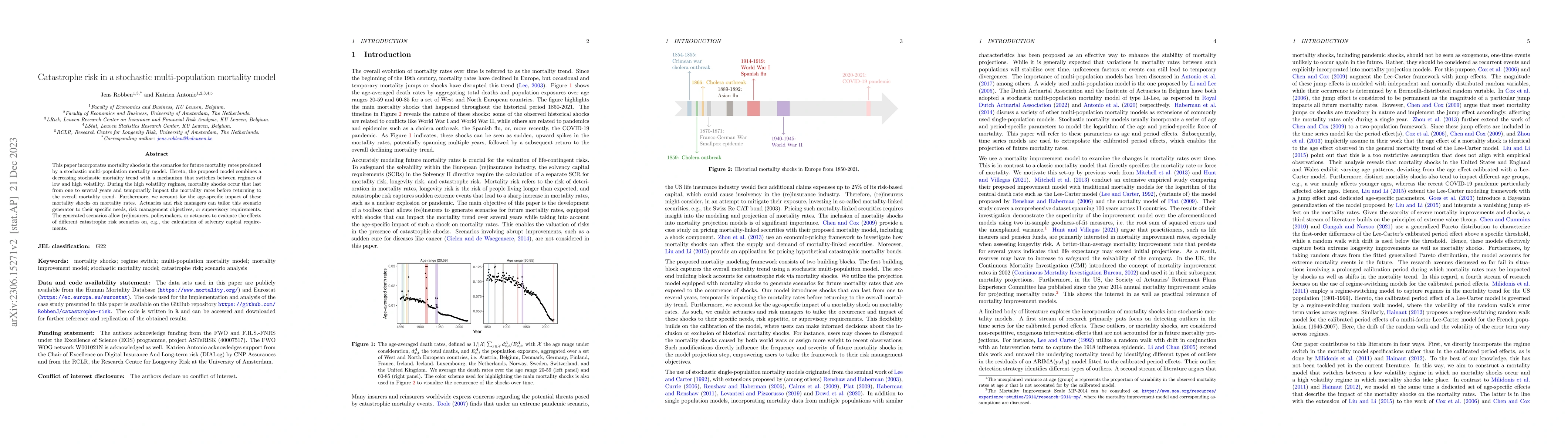

This paper presents an approach to incorporate mortality shocks into mortality projections produced by a stochastic multi-population mortality model. The proposed model combines a decreasing stochastic mortality trend with a regime-switching mechanism that captures age-specific mortality shocks over a lengthy calibration period. The result is a flexible and powerful toolbox that actuaries and risk managers can tailor to their specific needs, risk appetite, or supervisory requirements. We illustrate the proposed mortality model with a case study on projecting Dutch mortality rates. Our findings show that the proposed model generates wider prediction intervals for the mortality rates compared to state-of-the-art stochastic mortality models. The width of these prediction intervals depends on the frequency and severity of the mortality shocks calibrated with the regime-switching model. Furthermore, we compare the solvency capital requirement (SCR) for mortality, longevity and catastrophe risk generated by our toolbox with the SCR under the Solvency II standard model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAssessing Climate-Driven Mortality Risk: A Stochastic Approach with Distributed Lag Non-Linear Models

Han Li, Thomas Nagler, Shuanming Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)