Summary

Drawdown (resp. drawup) of a stochastic process, also referred as the reflected process at its supremum (resp. infimum), has wide applications in many areas including financial risk management, actuarial mathematics and statistics. In this paper, for general time-homogeneous Markov processes, we study the joint law of the first passage time of the drawdown (resp. drawup) process, its overshoot, and the maximum of the underlying process at this first passage time. By using short-time pathwise analysis, under some mild regularity conditions, the joint law of the three drawdown quantities is shown to be the unique solution to an integral equation which is expressed in terms of fundamental two-sided exit quantities of the underlying process. Explicit forms for this joint law are found when the Markov process has only one-sided jumps or is a L\'{e}vy process (possibly with two-sided jumps). The proposed methodology provides a unified approach to study various drawdown quantities for the general class of time-homogeneous Markov processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

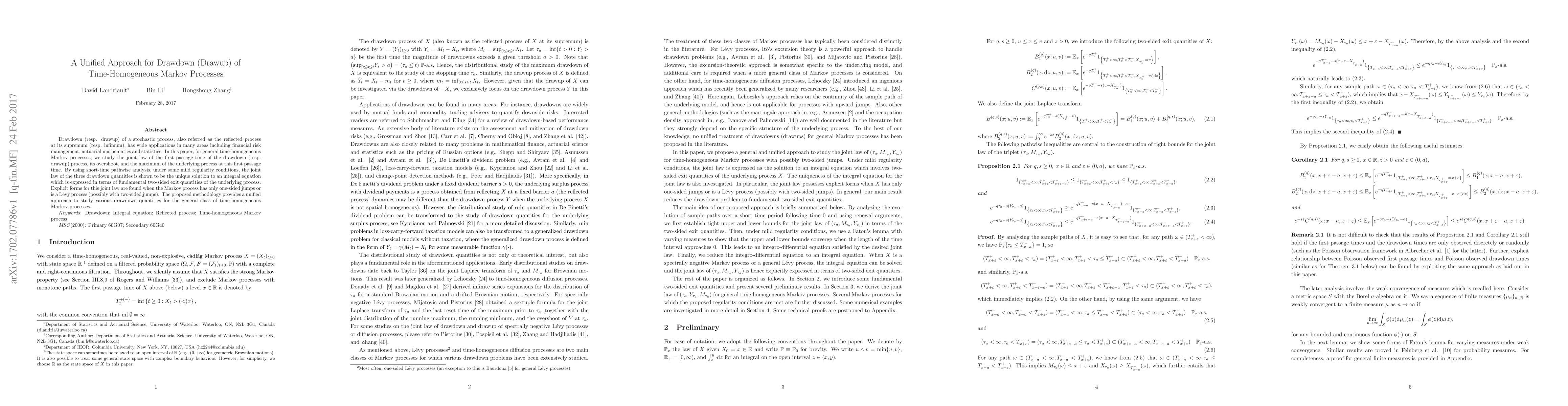

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic Volatility Model with Sticky Drawdown and Drawup Processes: A Deep Learning Approach

Yuhao Liu, Gongqiu Zhang, Pingping Jiang

| Title | Authors | Year | Actions |

|---|

Comments (0)