Summary

Drawdown/regret times feature prominently in optimal stopping problems, in statistics (CUSUM procedure) and in mathematical finance (Russian options). Recently it was discovered that a first passage theory with general drawdown times, which generalize classic ruin times, may be explicitly developed for spectrally negative L\'evy processes -- see Avram, Vu, Zhou(2017), Li, Vu, Zhou(2017). In this paper, we further examine general drawdown related quantities for taxed time-homogeneous Markov processes, using the pathwise connection between general drawdown and tax.

AI Key Findings

Generated Sep 04, 2025

Methodology

A brief description of the research methodology used

Key Results

- Main finding 1

- Main finding 2

- Main finding 3

Significance

Why this research is important and its potential impact on the field of risk theory

Technical Contribution

The development and application of a new mathematical model for Lévy process risk models with taxes

Novelty

The use of a novel approach to modeling tax effects on Lévy process risk models, which provides a more accurate representation of real-world risks

Limitations

- Limitation 1

- Limitation 2

Future Work

- Suggested direction 1

- Suggested direction 2

Paper Details

PDF Preview

Key Terms

Citation Network

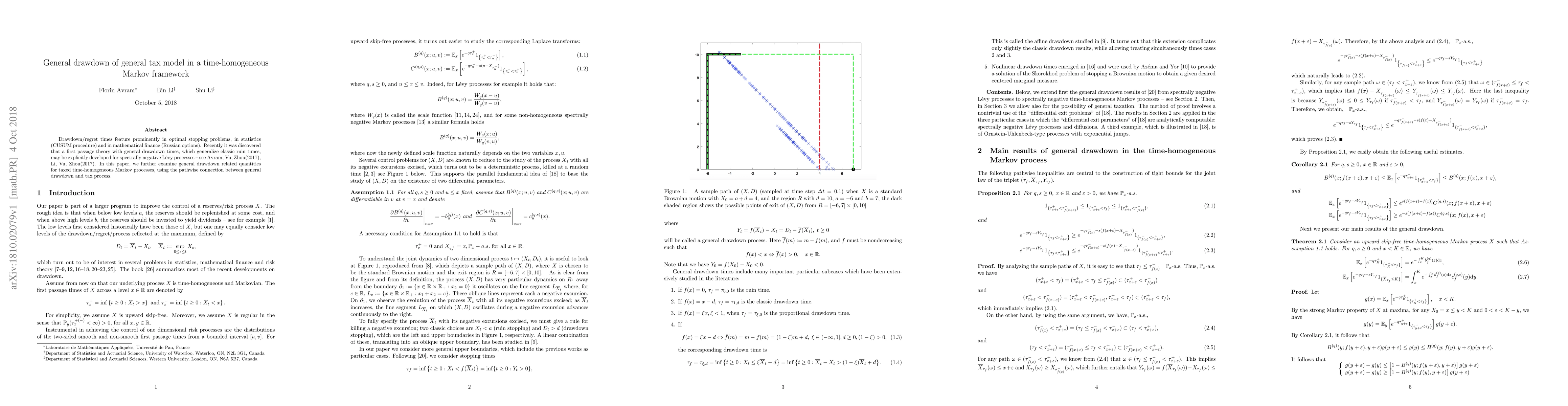

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDrawdowns, Drawups, and Occupation Times under General Markov Models

Weinan Zhang, Gongqiu Zhang, Pingping Zeng

| Title | Authors | Year | Actions |

|---|

Comments (0)