Authors

Summary

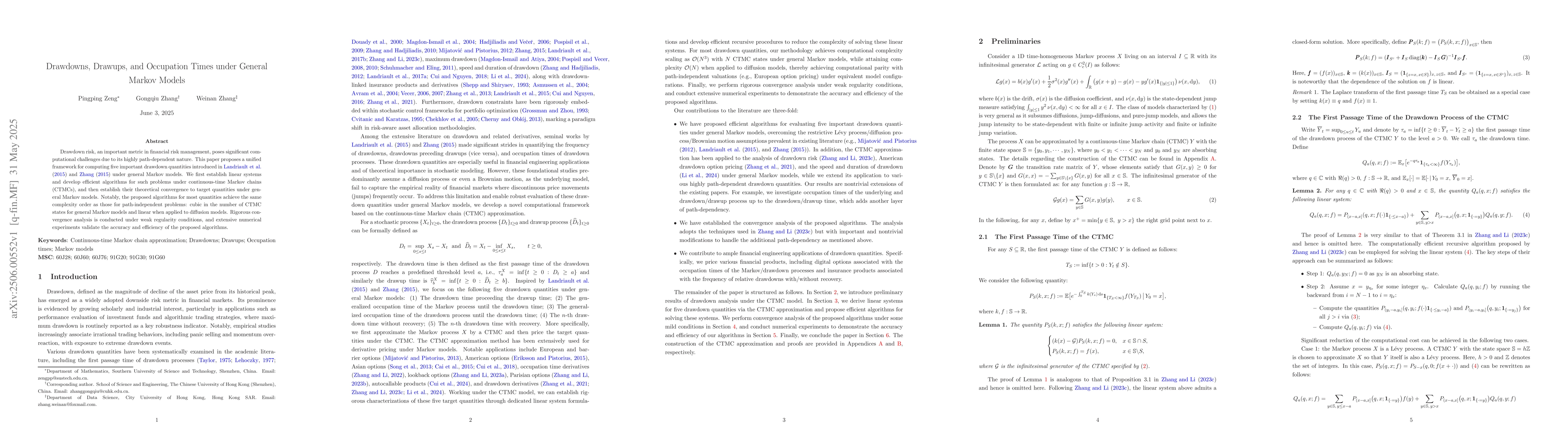

Drawdown risk, an important metric in financial risk management, poses significant computational challenges due to its highly path-dependent nature. This paper proposes a unified framework for computing five important drawdown quantities introduced in Landriault et al. (2015) and Zhang (2015) under general Markov models. We first establish linear systems and develop efficient algorithms for such problems under continuous-time Markov chains (CTMCs), and then establish their theoretical convergence to target quantities under general Markov models. Notably, the proposed algorithms for most quantities achieve the same complexity order as those for path-independent problems: cubic in the number of CTMC states for general Markov models and linear when applied to diffusion models. Rigorous convergence analysis is conducted under weak regularity conditions, and extensive numerical experiments validate the accuracy and efficiency of the proposed algorithms.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper establishes linear systems and develops efficient algorithms for computing drawdown quantities under continuous-time Markov chains (CTMCs), extending these to general Markov models with rigorous convergence analysis.

Key Results

- Unified framework for calculating five important drawdown quantities under general Markov models.

- Proposed algorithms achieve cubic complexity in the number of CTMC states for general Markov models and linear complexity for diffusion models.

Significance

This research is significant for financial risk management as it addresses computational challenges associated with drawdown risk, a crucial metric, by providing efficient algorithms with proven convergence.

Technical Contribution

The development of linear systems and efficient algorithms for computing drawdown quantities under general Markov models, along with their convergence analysis.

Novelty

The paper presents a novel approach that simplifies the computation of drawdown quantities to the same complexity order as path-independent problems, distinguishing it from previous work.

Limitations

- The paper does not discuss potential limitations explicitly within the provided content.

- Practical applicability to real-world financial data might require further investigation.

Future Work

- Exploring applications of the proposed algorithms to specific financial risk management scenarios.

- Investigating the performance of the algorithms on more complex, high-dimensional Markov models.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)