Authors

Summary

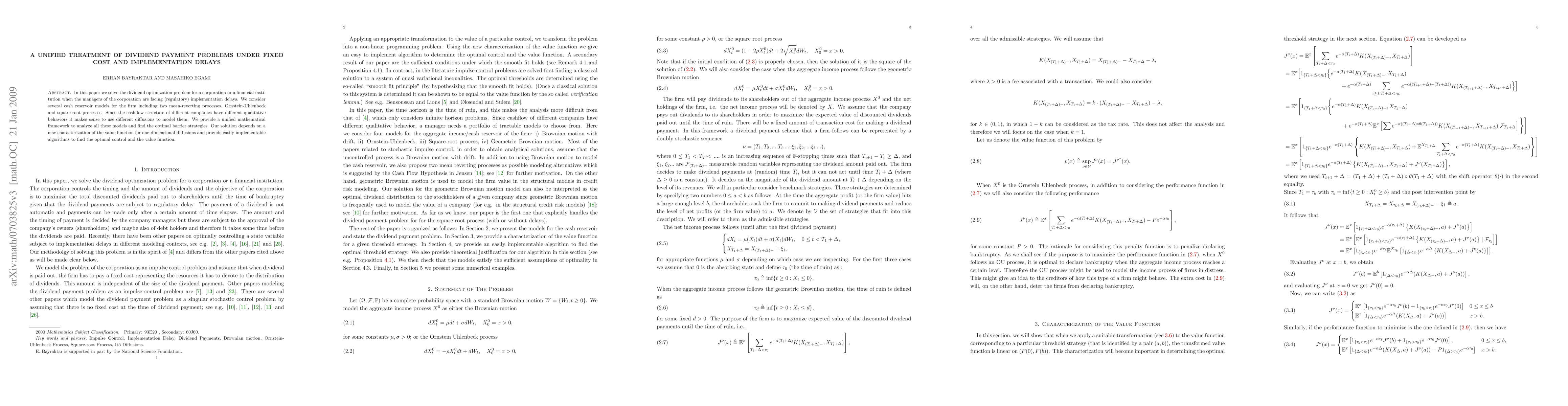

In this paper we solve the dividend optimization problem for a corporation or a financial institution when the managers of the corporation are facing (regulatory) implementation delays. We consider several cash reservoir models for the firm including two mean-reverting processes, Ornstein-Uhlenbeck and square-root processes. We provide our solution via a new characterization of the value function for one-dimensional diffusions and provide easily implementable algorithms to find the optimal control and the value function.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)