Summary

We address the Merton problem of maximizing the expected utility of terminal wealth using techniques from variational analysis. Under a general continuous semimartingale market model with stochastic parameters, we obtain a characterization of the optimal portfolio for general utility functions in terms of a forward-backward stochastic differential equation (FBSDE) and derive solutions for a number of well-known utility functions. Our results complement a previous studies conducted on optimal strategies in markets driven by Brownian noise with random drift and volatility parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

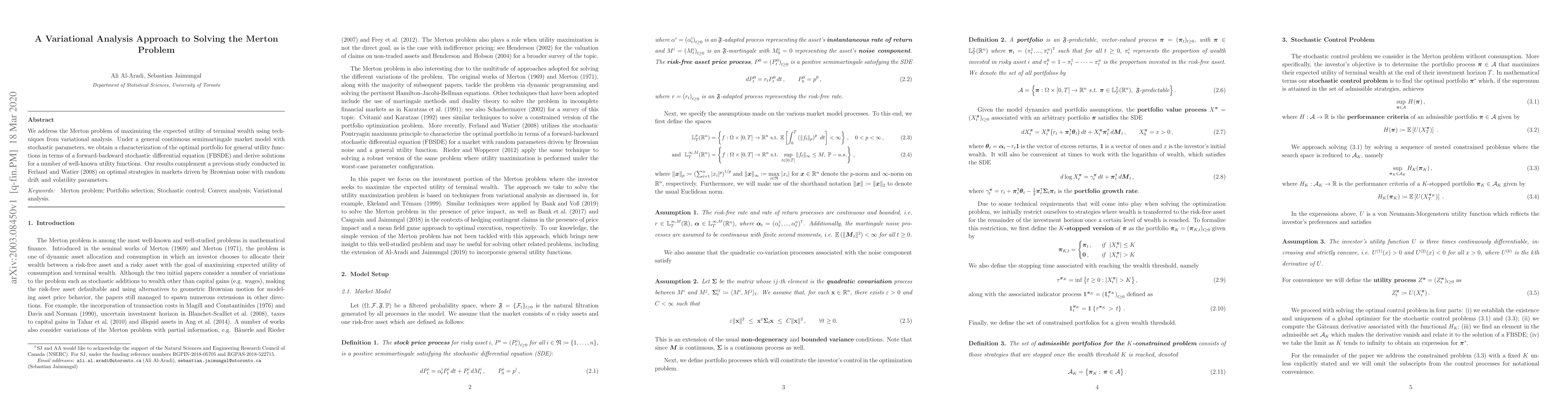

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)