Summary

In this article we consider the infinite-horizon Merton investment-consumption problem in a constant-parameter Black - Scholes - Merton market for an agent with constant relative risk aversion R. The classical primal approach is to write down a candidate value function and to use a verification argument to prove that this is the solution to the problem. However, features of the problem take it outside the standard settings of stochastic control, and the existing primal verification proofs rely on parameter restrictions (especially, but not only, R<1), restrictions on the space of admissible strategies, or intricate approximation arguments. The purpose of this paper is to show that these complications can be overcome using a simple and elegant argument involving a stochastic perturbation of the utility function.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

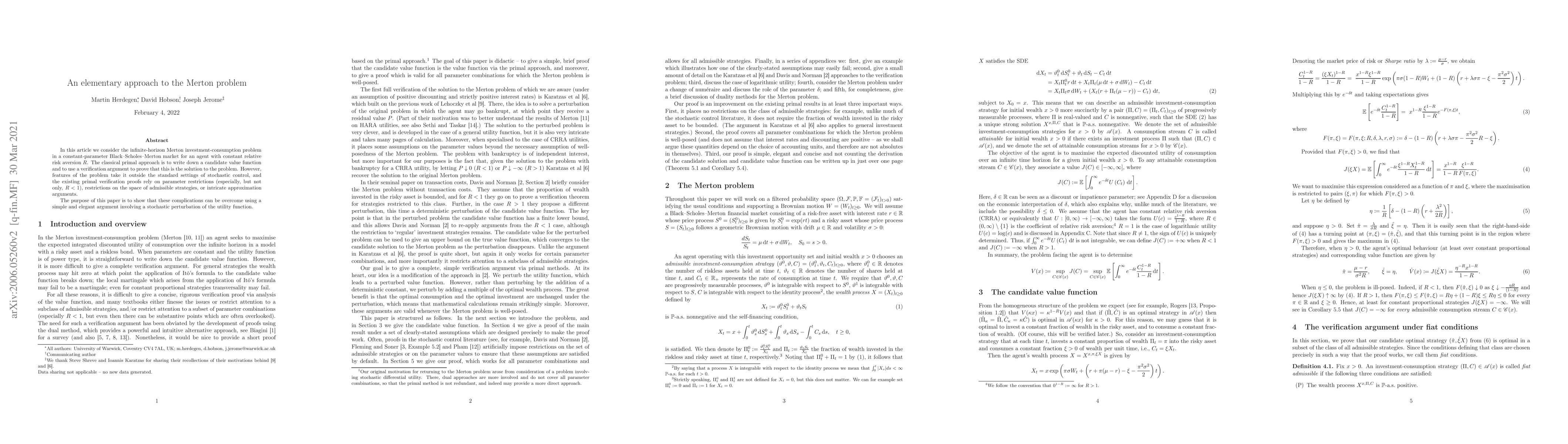

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)