Summary

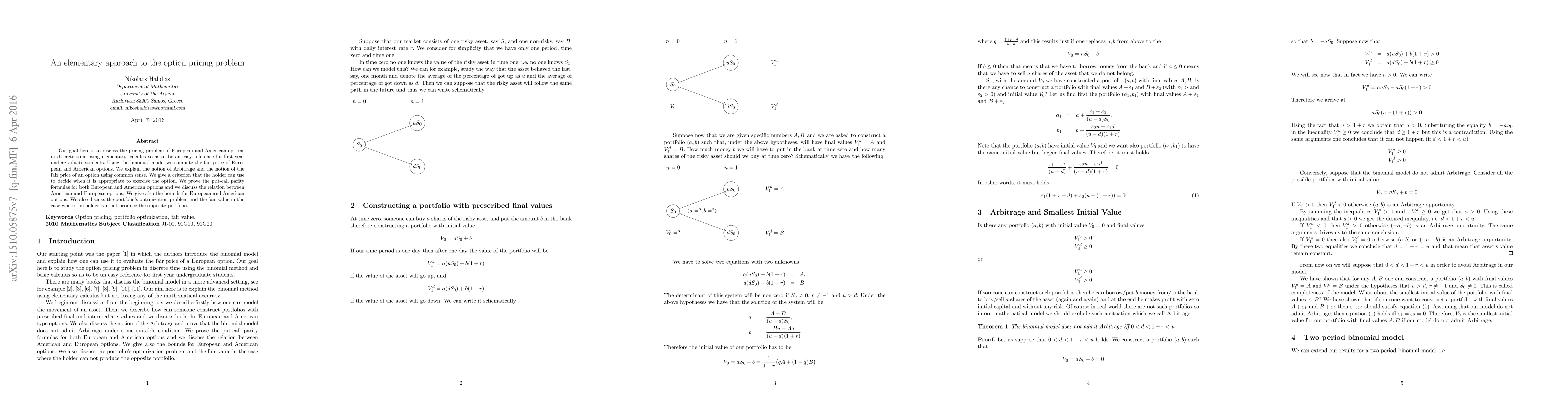

Our goal here is to discuss the pricing problem of European and American options in discrete time using elementary calculus so as to be an easy reference for first year undergraduate students. Using the binomial model we compute the fair price of European and American options. We explain the notion of Arbitrage and the notion of the fair price of an option using common sense. We give a criterion that the holder can use to decide when it is appropriate to exercise the option. We prove the put-call parity formulas for both European and American options and we discuss the relation between American and European options. We give also the bounds for European and American options. We also discuss the portfolio's optimization problem and the fair value in the case where the holder can not produce the opposite portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Hamiltonian Approach to Floating Barrier Option Pricing

Qi Chen, Chao Guo, Hong-tao Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)