Summary

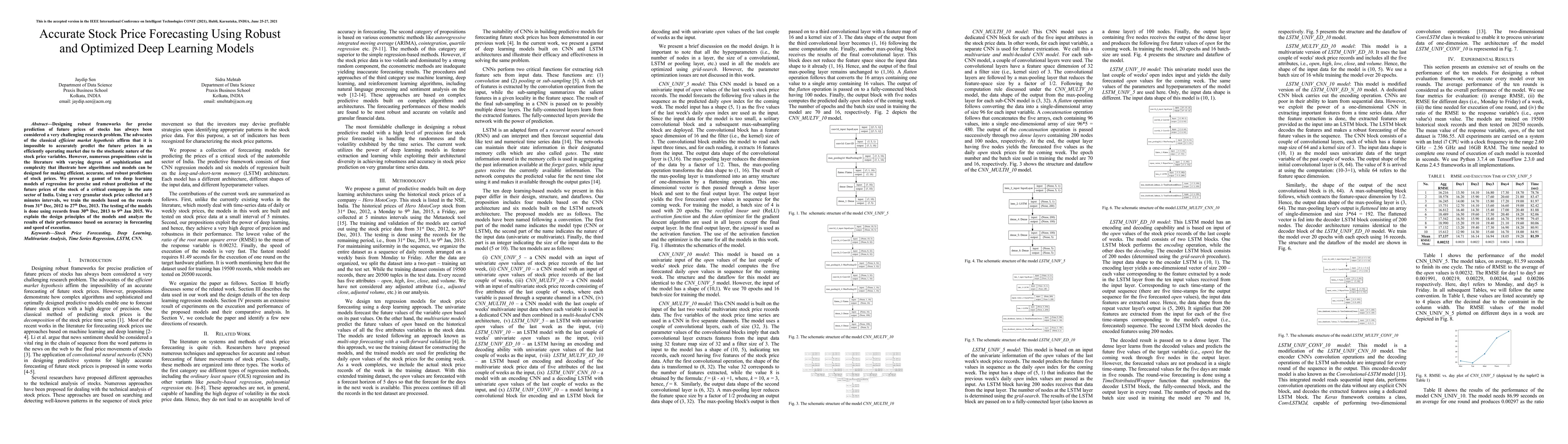

Designing robust frameworks for precise prediction of future prices of stocks has always been considered a very challenging research problem. The advocates of the classical efficient market hypothesis affirm that it is impossible to accurately predict the future prices in an efficiently operating market due to the stochastic nature of the stock price variables. However, numerous propositions exist in the literature with varying degrees of sophistication and complexity that illustrate how algorithms and models can be designed for making efficient, accurate, and robust predictions of stock prices. We present a gamut of ten deep learning models of regression for precise and robust prediction of the future prices of the stock of a critical company in the auto sector of India. Using a very granular stock price collected at 5 minutes intervals, we train the models based on the records from 31st Dec, 2012 to 27th Dec, 2013. The testing of the models is done using records from 30th Dec, 2013 to 9th Jan 2015. We explain the design principles of the models and analyze the results of their performance based on accuracy in forecasting and speed of execution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)