Summary

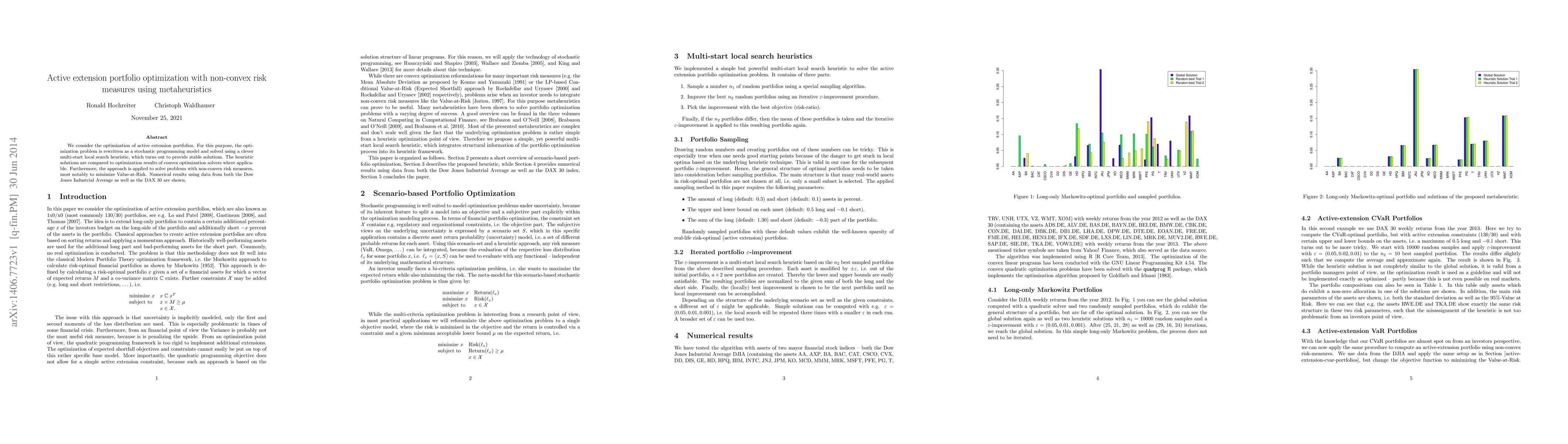

We consider the optimization of active extension portfolios. For this purpose, the optimization problem is rewritten as a stochastic programming model and solved using a clever multi-start local search heuristic, which turns out to provide stable solutions. The heuristic solutions are compared to optimization results of convex optimization solvers where applicable. Furthermore, the approach is applied to solve problems with non-convex risk measures, most notably to minimize Value-at-Risk. Numerical results using data from both the Dow Jones Industrial Average as well as the DAX 30 are shown.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)