Summary

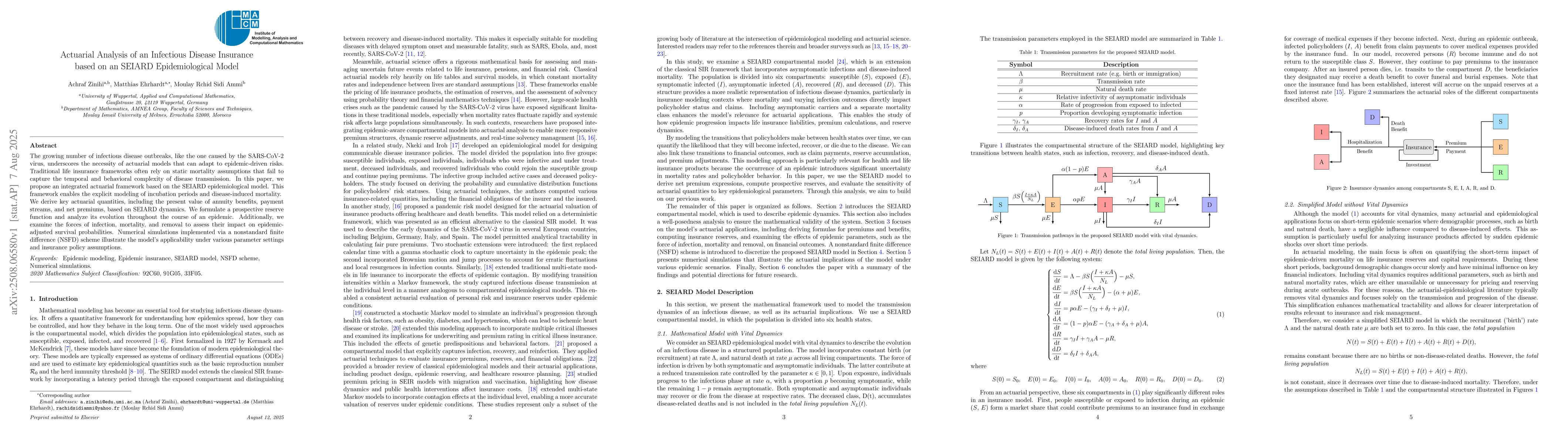

The growing number of infectious disease outbreaks, like the one caused by the SARS-CoV-2 virus, underscores the necessity of actuarial models that can adapt to epidemic-driven risks. Traditional life insurance frameworks often rely on static mortality assumptions that fail to capture the temporal and behavioral complexity of disease transmission. In this paper, we propose an integrated actuarial framework based on the SEIARD epidemiological model. This framework enables the explicit modeling of incubation periods and disease-induced mortality. We derive key actuarial quantities, including the present value of annuity benefits, payment streams, and net premiums, based on SEIARD dynamics. We formulate a prospective reserve function and analyze its evolution throughout the course of an epidemic. Additionally, we examine the forces of infection, mortality, and removal to assess their impact on epidemic-adjusted survival probabilities. Numerical simulations implemented via a nonstandard finite difference (NSFD) scheme illustrate the model's applicability under various parameter settings and insurance policy assumptions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersQuantum Computational Insurance and Actuarial Science

Chao Wang, Yu-Chun Wu, Guo-Ping Guo et al.

Actuarial-consistency and two-step actuarial valuations: a new paradigm to insurance valuation

Fan Yang, Karim Barigou, Daniël Linders

Comments (0)