Authors

Summary

This paper introduces new valuation schemes called actuarial-consistent valuations for insurance liabilities which depend on both financial and actuarial risks, which imposes that all actuarial risks are priced via standard actuarial principles. We propose to extend standard actuarial principles by a new actuarial-consistent procedure, which we call "two-step actuarial valuations". \bluebis{In the case valuations are coherent}, we show that actuarial-consistent valuations are equivalent to two-step actuarial valuations. We also discuss the connection with "two-step market-consistent valuations" from Pelsser and Stadje (2014). In particular, we discuss how the dependence structure between actuarial and financial risks impacts both actuarial-consistent and market-consistent valuations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

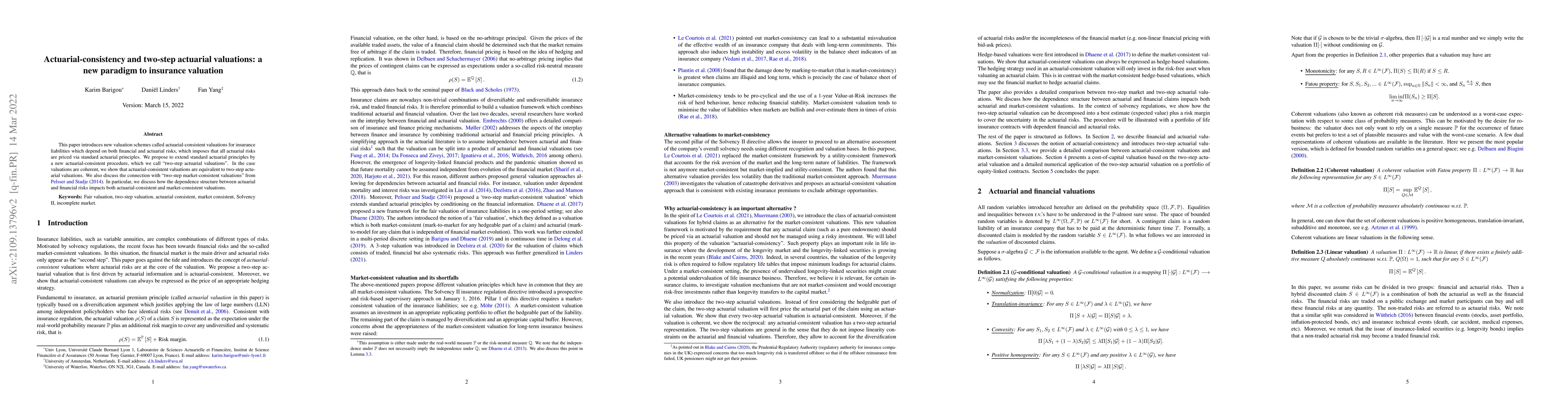

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantum Computational Insurance and Actuarial Science

Chao Wang, Yu-Chun Wu, Guo-Ping Guo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)