Summary

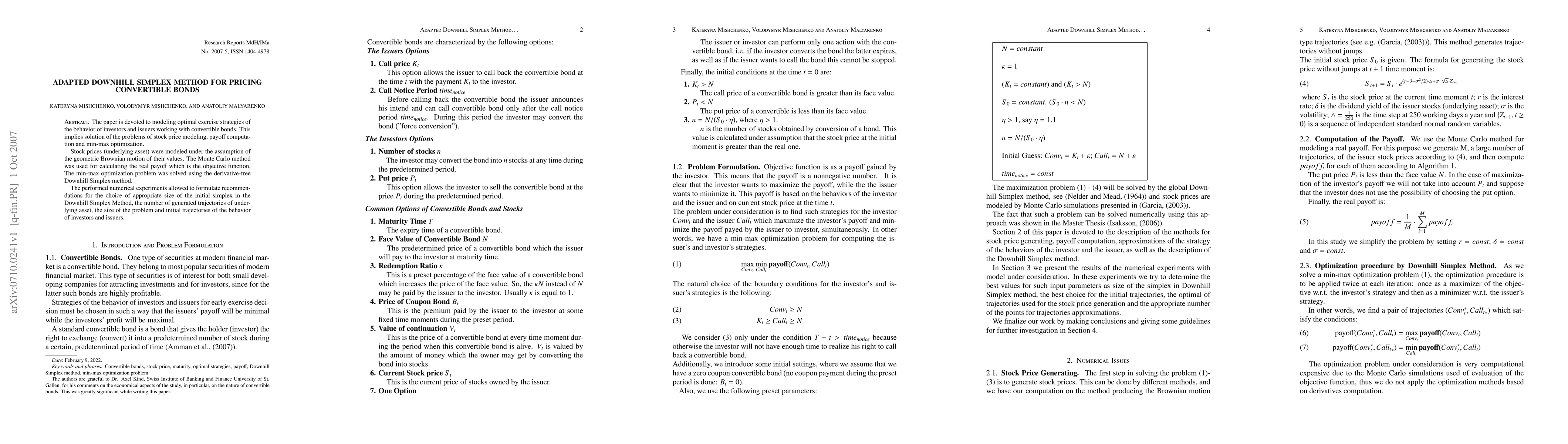

The paper is devoted to modeling optimal exercise strategies of the behavior of investors and issuers working with convertible bonds. This implies solution of the problems of stock price modeling, payoff computation and min-max optimization. Stock prices (underlying asset) were modeled under the assumption of the geometric Brownian motion of their values. The Monte Carlo method was used for calculating the real payoff which is the objective function. The min-max optimization problem was solved using the derivative-free Downhill Simplex method. The performed numerical experiments allowed to formulate recommendations for the choice of appropriate size of the initial simplex in the Downhill Simplex Method, the number of generated trajectories of underlying asset, the size of the problem and initial trajectories of the behavior of investors and issuers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIsogeometric Analysis for the Pricing of Financial Derivatives with Nonlinear Models: Convertible Bonds and Options

Yogi Erlangga, Yerlan Amanbek, Rakhymzhan Kazbek et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)