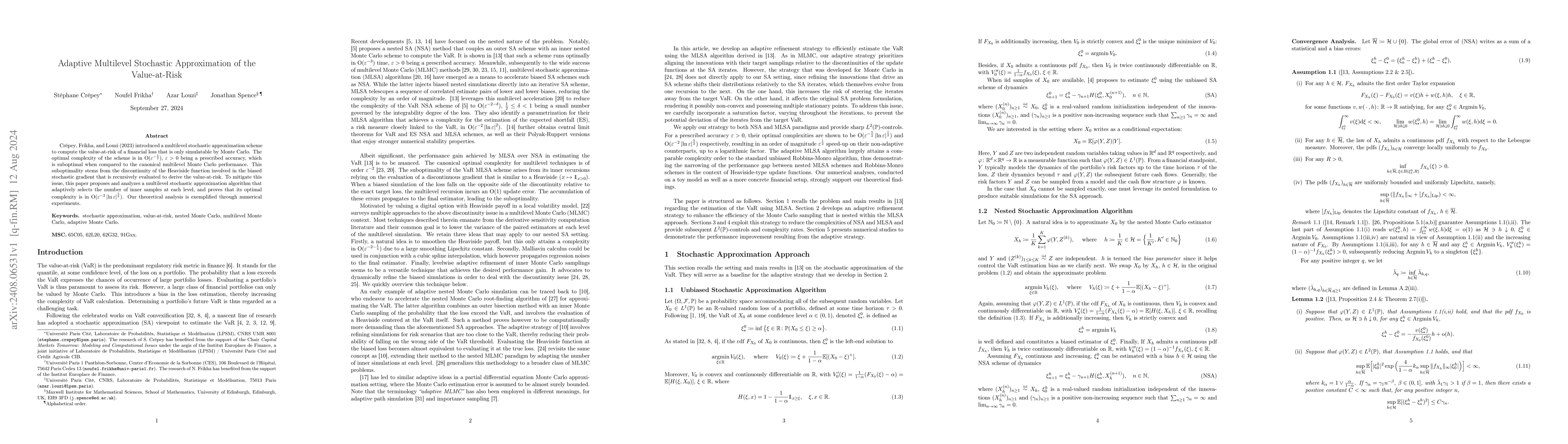

Summary

Cr\'epey, Frikha, and Louzi (2023) introduced a multilevel stochastic approximation scheme to compute the value-at-risk of a financial loss that is only simulatable by Monte Carlo. The optimal complexity of the scheme is in $O({\varepsilon}^{-5/2})$, ${\varepsilon} > 0$ being a prescribed accuracy, which is suboptimal when compared to the canonical multilevel Monte Carlo performance. This suboptimality stems from the discontinuity of the Heaviside function involved in the biased stochastic gradient that is recursively evaluated to derive the value-at-risk. To mitigate this issue, this paper proposes and analyzes a multilevel stochastic approximation algorithm that adaptively selects the number of inner samples at each level, and proves that its optimal complexity is in $O({\varepsilon}^{-2}|\ln {\varepsilon}|^{5/2})$. Our theoretical analysis is exemplified through numerical experiments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Multilevel Stochastic Approximation Algorithm for Value-at-Risk and Expected Shortfall Estimation

Noufel Frikha, Stéphane Crépey, Azar Louzi

Asymptotic Error Analysis of Multilevel Stochastic Approximations for the Value-at-Risk and Expected Shortfall

Noufel Frikha, Stéphane Crépey, Azar Louzi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)