Summary

We demonstrate the use of Adaptive Stress Testing to detect and address potential vulnerabilities in a financial environment. We develop a simplified model for credit card fraud detection that utilizes a linear regression classifier based on historical payment transaction data coupled with business rules. We then apply the reinforcement learning model known as Adaptive Stress Testing to train an agent, that can be thought of as a potential fraudster, to find the most likely path to system failure -- successfully defrauding the system. We show the connection between this most likely failure path and the limits of the classifier and discuss how the fraud detection system's business rules can be further augmented to mitigate these failure modes.

AI Key Findings

Generated Sep 03, 2025

Methodology

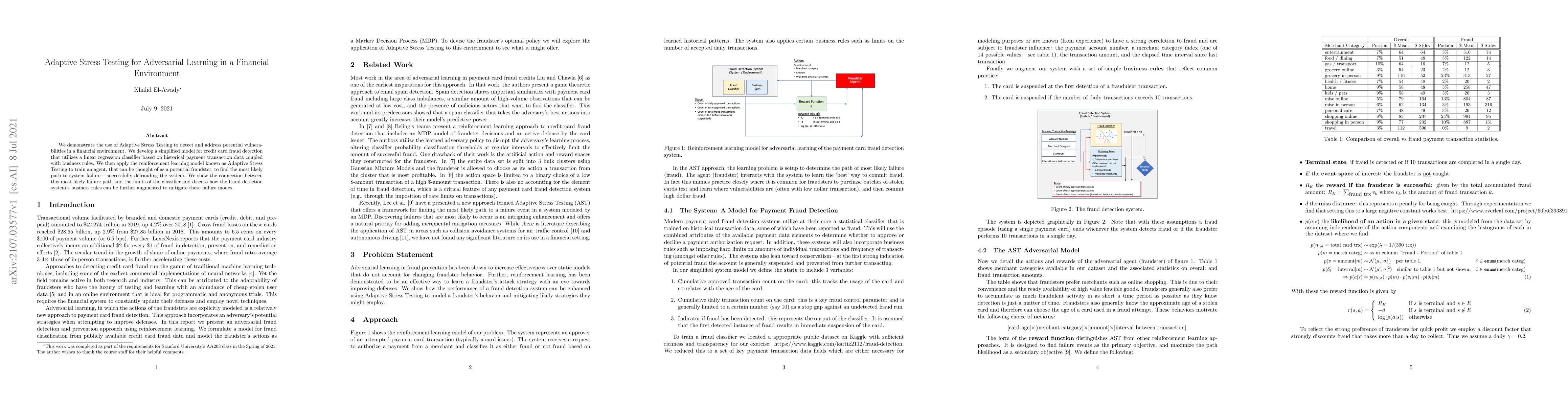

The paper demonstrates Adaptive Stress Testing (AST) for adversarial learning in a financial environment using a simplified credit card fraud detection model based on historical transaction data and business rules. A reinforcement learning model is applied to train an agent simulating a potential fraudster to find the most likely path to system failure.

Key Results

- The paper successfully identifies the most likely failure path in the fraud detection system, linking it to the classifier's limitations.

- It shows how business rules can be augmented to mitigate identified failure modes.

- Experiments reveal that fraudsters prefer online shopping and moderate transaction amounts, indicating potential blind spots in the current fraud detection system.

Significance

This research is important as it proposes a novel approach to detect vulnerabilities in financial systems using adversarial learning, potentially improving fraud detection systems and reducing financial losses due to fraud.

Technical Contribution

The paper introduces Adaptive Stress Testing (AST) as a method for adversarial learning in financial systems, demonstrating its application in a credit card fraud detection scenario.

Novelty

The research presents a novel application of reinforcement learning in identifying vulnerabilities in financial systems, focusing on credit card fraud detection, and proposes ways to improve system resilience through business rule augmentation.

Limitations

- The study is limited to a simplified model of credit card fraud detection, which may not fully capture the complexities of real-world systems.

- The findings are based on a specific dataset, and generalizability to other financial environments might be limited.

Future Work

- Further exploration of this adversarial learning approach in an interactive game-like setting to fine-tune fraud detection systems.

- Investigating automated processes for generating business rules in response to identified fraud strategies.

- Enhancing the fraud classifier with more sophisticated models and additional data fields.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMachine Learning Based Stress Testing Framework for Indian Financial Market Portfolios

Siddhartha P. Chakrabarty, Vidya Sagar G, Shifat Ali

| Title | Authors | Year | Actions |

|---|

Comments (0)