Summary

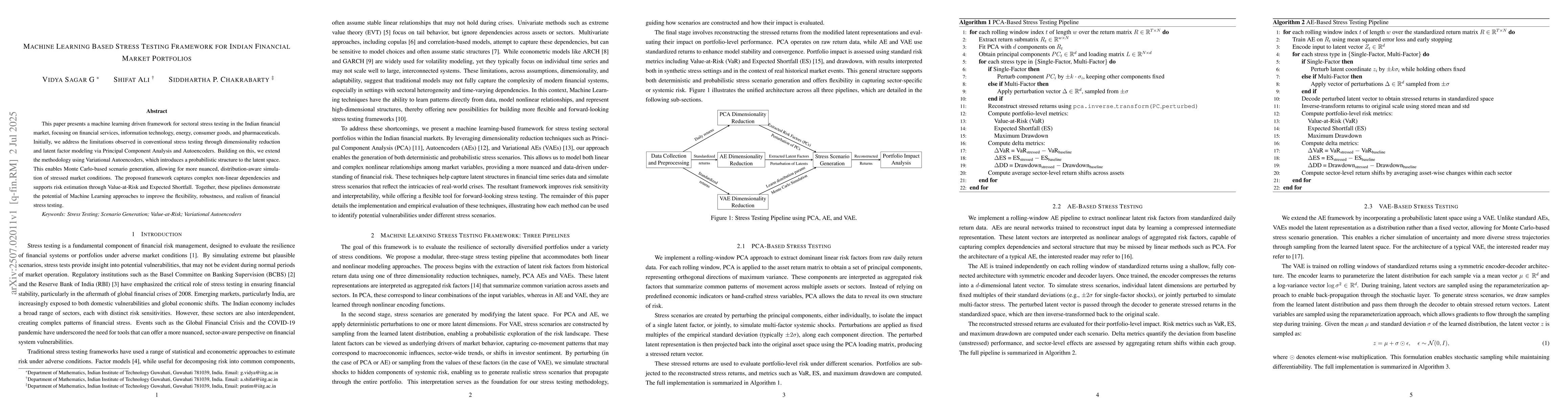

This paper presents a machine learning driven framework for sectoral stress testing in the Indian financial market, focusing on financial services, information technology, energy, consumer goods, and pharmaceuticals. Initially, we address the limitations observed in conventional stress testing through dimensionality reduction and latent factor modeling via Principal Component Analysis and Autoencoders. Building on this, we extend the methodology using Variational Autoencoders, which introduces a probabilistic structure to the latent space. This enables Monte Carlo-based scenario generation, allowing for more nuanced, distribution-aware simulation of stressed market conditions. The proposed framework captures complex non-linear dependencies and supports risk estimation through Value-at-Risk and Expected Shortfall. Together, these pipelines demonstrate the potential of Machine Learning approaches to improve the flexibility, robustness, and realism of financial stress testing.

AI Key Findings

Generated Sep 07, 2025

Methodology

This paper proposes a machine learning-driven stress testing framework for Indian financial market portfolios, focusing on five key sectors: financial services, information technology, energy, consumer goods, and pharmaceuticals. It addresses limitations of conventional stress testing through dimensionality reduction using Principal Component Analysis (PCA) and latent factor modeling via Autoencoders (AE), extending further with Variational Autoencoders (VAE) for probabilistic scenario generation.

Key Results

- The VAE-based framework captures complex non-linear dependencies and supports risk estimation through Value-at-Risk (VaR) and Expected Shortfall (ES).

- PCA-based stress testing reveals substantial increase in tail risk during major market downturns, with the first principal component dominating the stress response.

- AE-based stress testing captures more subtle non-linear responses, offering better expressiveness for real-world volatility compared to PCA.

- VAE-based Monte Carlo stress testing provides a probabilistic perspective on portfolio stress, enabling the exploration of a broader range of plausible stress scenarios.

- All three methods (PCA, AE, and VAE) consistently show sector-level vulnerabilities, particularly in Financial Services and Energy during periods of elevated market stress.

Significance

This research is significant as it integrates linear and non-linear dimensionality reduction techniques (PCA, AE, and VAE) within a modular pipeline for scenario generation and portfolio risk evaluation, offering a robust, data-driven approach to financial stress testing.

Technical Contribution

The paper introduces a novel machine learning-based stress testing framework that combines PCA, AEs, and VAEs, offering a flexible and robust approach to modeling latent risk factors and evaluating portfolio resilience.

Novelty

This work stands out by integrating linear (PCA) and non-linear (AE, VAE) dimensionality reduction techniques within a single framework for stress testing, providing both interpretability and the ability to capture complex, non-linear dependencies in financial market data.

Limitations

- The study's reliance on historical data may limit its predictive power for future, unprecedented events.

- The black-box nature of neural encoders in AEs and VAEs may hinder interpretability.

Future Work

- Exploration of alternative architectures for scenario generation and latent factor modeling, such as attention-based networks or sequence models.

- Incorporation of multi-asset portfolios, macroeconomic, and sentiment data into the framework for more comprehensive stress testing.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComplexity-based Financial Stress Evaluation

Danilo P. Mandic, Yao Lei Xu, Hongjian Xiao

No citations found for this paper.

Comments (0)