Authors

Summary

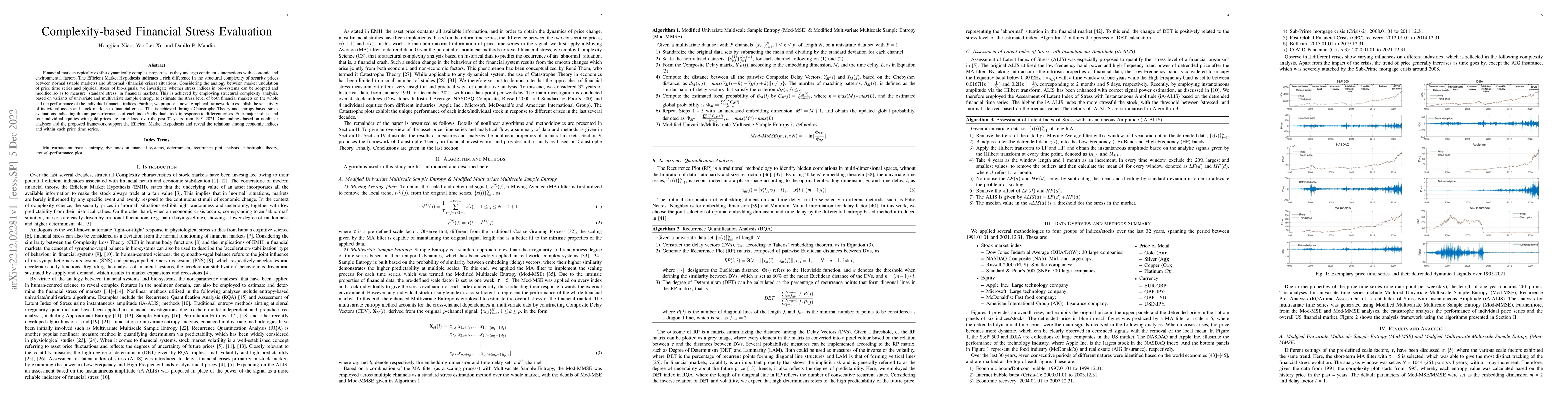

Financial markets typically exhibit dynamically complex properties as they undergo continuous interactions with economic and environmental factors. The Efficient Market Hypothesis indicates a rich difference in the structural complexity of security prices between normal (stable markets) and abnormal (financial crises) situations. Considering the analogy between market undulation of price time series and physical stress of bio-signals, we investigate whether stress indices in bio-systems can be adopted and modified so as to measure 'standard stress' in financial markets. This is achieved by employing structural complexity analysis, based on variants of univariate and multivariate sample entropy, to estimate the stress level of both financial markets on the whole and the performance of the individual financial indices. Further, we propose a novel graphical framework to establish the sensitivity of individual assets and stock markets to financial crises. This is achieved through Catastrophe Theory and entropy-based stress evaluations indicating the unique performance of each index/individual stock in response to different crises. Four major indices and four individual equities with gold prices are considered over the past 32 years from 1991-2021. Our findings based on nonlinear analyses and the proposed framework support the Efficient Market Hypothesis and reveal the relations among economic indices and within each price time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMachine Learning Based Stress Testing Framework for Indian Financial Market Portfolios

Siddhartha P. Chakrabarty, Vidya Sagar G, Shifat Ali

No citations found for this paper.

Comments (0)