Authors

Summary

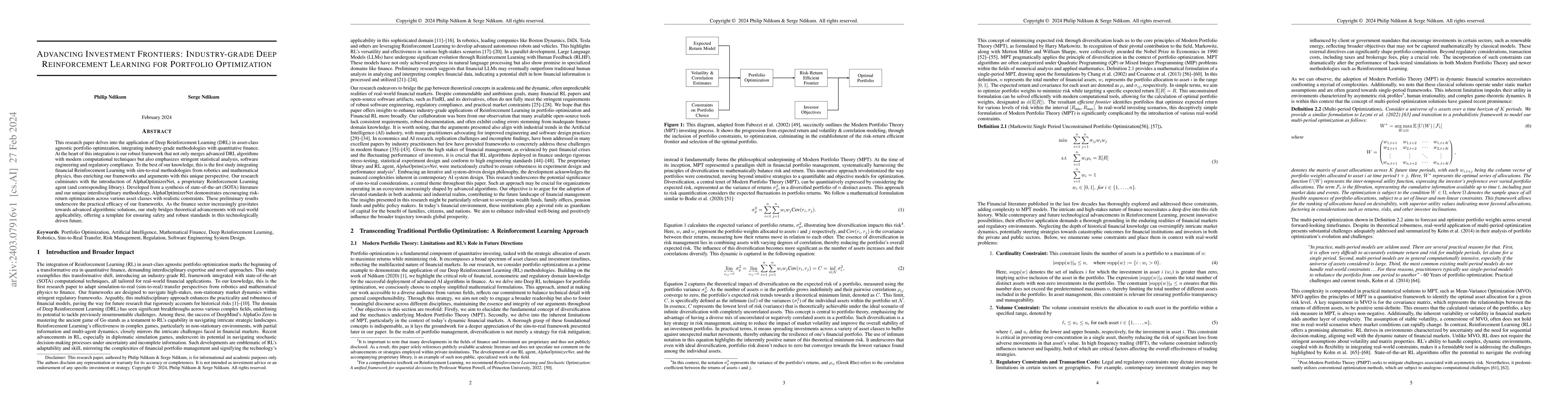

This research paper delves into the application of Deep Reinforcement Learning (DRL) in asset-class agnostic portfolio optimization, integrating industry-grade methodologies with quantitative finance. At the heart of this integration is our robust framework that not only merges advanced DRL algorithms with modern computational techniques but also emphasizes stringent statistical analysis, software engineering and regulatory compliance. To the best of our knowledge, this is the first study integrating financial Reinforcement Learning with sim-to-real methodologies from robotics and mathematical physics, thus enriching our frameworks and arguments with this unique perspective. Our research culminates with the introduction of AlphaOptimizerNet, a proprietary Reinforcement Learning agent (and corresponding library). Developed from a synthesis of state-of-the-art (SOTA) literature and our unique interdisciplinary methodology, AlphaOptimizerNet demonstrates encouraging risk-return optimization across various asset classes with realistic constraints. These preliminary results underscore the practical efficacy of our frameworks. As the finance sector increasingly gravitates towards advanced algorithmic solutions, our study bridges theoretical advancements with real-world applicability, offering a template for ensuring safety and robust standards in this technologically driven future.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning and Mean-Variance Strategies for Responsible Portfolio Optimization

Manuela Veloso, Fernando Acero, Parisa Zehtabi et al.

Dynamic Optimization of Portfolio Allocation Using Deep Reinforcement Learning

Gang Huang, Qingyang Song, Xiaohua Zhou

Multimodal Deep Reinforcement Learning for Portfolio Optimization

James Zhang, Sumit Nawathe, Ravi Panguluri et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)