Summary

We develop the HJM framework for forward rates driven by affine processes on the state space of symmetric positive matrices. In this setting we find a representation for the long-term yield and investigate the yield's asymptotic behaviour.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

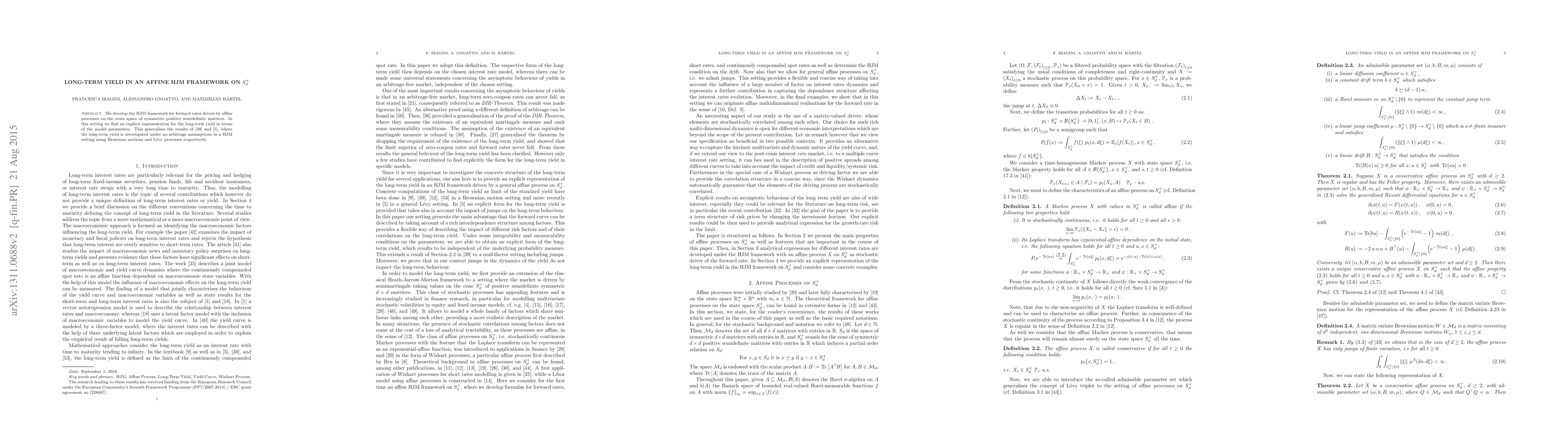

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)