Summary

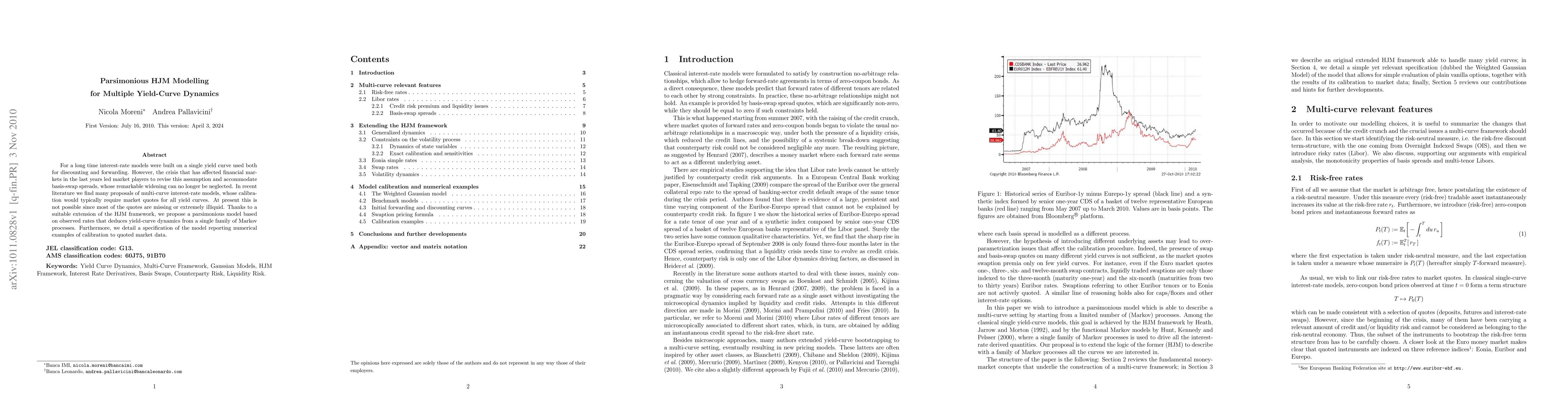

For a long time interest-rate models were built on a single yield curve used both for discounting and forwarding. However, the crisis that has affected financial markets in the last years led market players to revise this assumption and accommodate basis-swap spreads, whose remarkable widening can no longer be neglected. In recent literature we find many proposals of multi-curve interest-rate models, whose calibration would typically require market quotes for all yield curves. At present this is not possible since most of the quotes are missing or extremely illiquid. Thanks to a suitable extension of the HJM framework, we propose a parsimonious model based on observed rates that deduces yield-curve dynamics from a single family of Markov processes. Furthermore, we detail a specification of the model reporting numerical examples of calibration to quoted market data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)