Summary

This study deals with the pricing and hedging of single-tranche collateralized debt obligations (STCDOs). We specify an affine two-factor model in which a catastrophic risk component is incorporated. Apart from being analytically tractable, this model has the feature that it captures the dynamics of super-senior tranches, thanks to the catastrophic component. We estimate the factor model based on the iTraxx Europe data with six tranches and four different maturities, using a quasi-maximum likelihood (QML) approach in conjunction with the Kalman filter. We derive the model-based variance-minimizing strategy for the hedging of STCDOs with a dynamically rebalanced portfolio on the underlying swap index. We analyze the actual performance of the variance-minimizing hedge on the iTraxx Europe data. In order to assess the hedging performance further, we run a simulation analysis where normal and extreme loss scenarios are generated via the method of importance sampling. Both in-sample hedging and simulation analysis suggest that the variance-minimizing strategy is most effective for mezzanine tranches in terms of yielding less riskier hedging portfolios and it fails to provide adequate hedge performance regarding equity tranches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

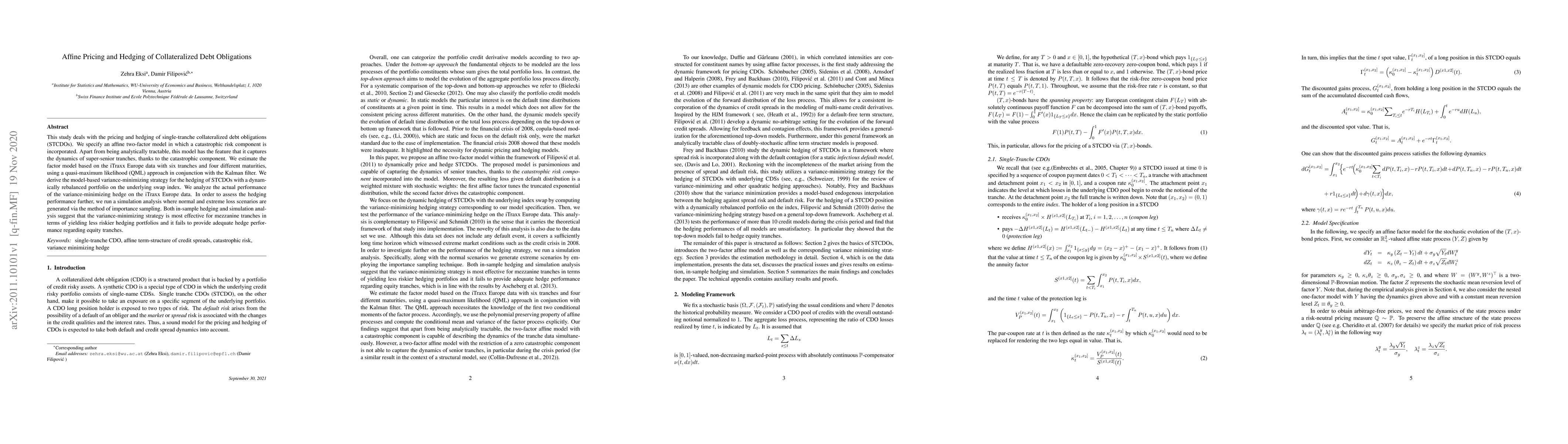

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)