Summary

The problem of existence of arbitrage free and monotone CDO term structure models is studied. Conditions for positivity and monotonicity of the corresponding Heath-Jarrow-Morton-Musiela equation for the $x$-forward rates with the use of the Milian type result are formulated. Two state spaces are taken into account - of square integrable functions and a Sobolev space. For the first the regularity results concerning pointwise monotonicity are proven. Arbitrage free and monotone models are characterized in terms of the volatility of the model and characteristics of the driving L\'evy process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

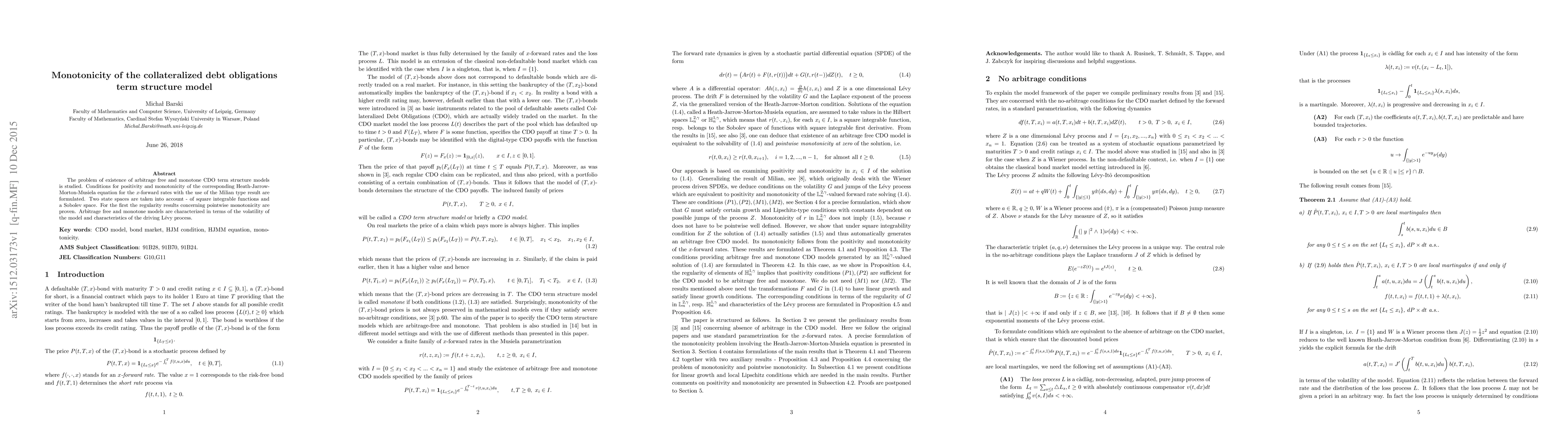

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)