Authors

Summary

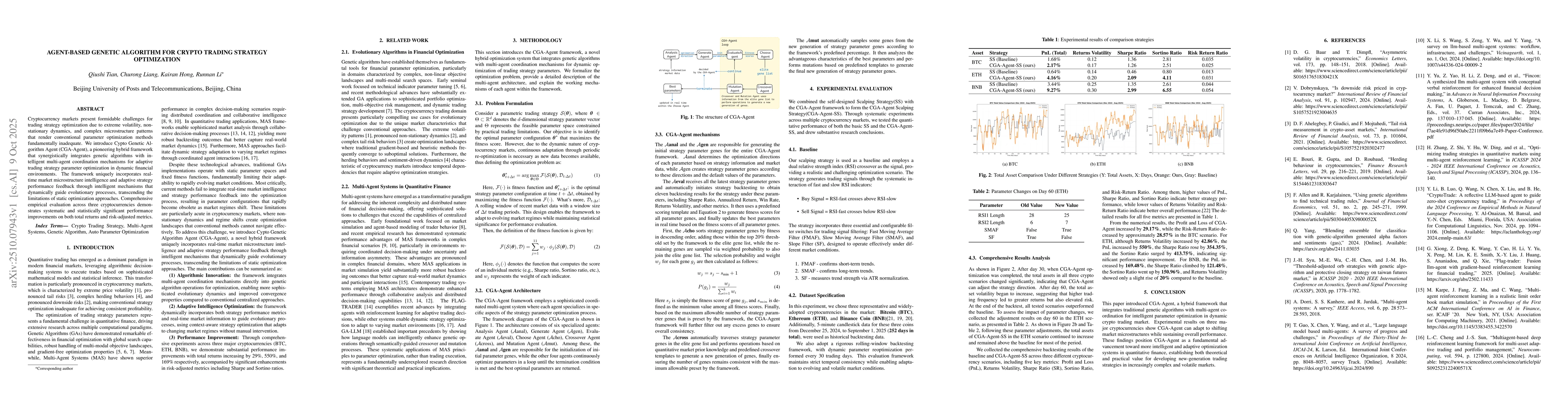

Cryptocurrency markets present formidable challenges for trading strategy optimization due to extreme volatility, non-stationary dynamics, and complex microstructure patterns that render conventional parameter optimization methods fundamentally inadequate. We introduce Cypto Genetic Algorithm Agent (CGA-Agent), a pioneering hybrid framework that synergistically integrates genetic algorithms with intelligent multi-agent coordination mechanisms for adaptive trading strategy parameter optimization in dynamic financial environments. The framework uniquely incorporates real-time market microstructure intelligence and adaptive strategy performance feedback through intelligent mechanisms that dynamically guide evolutionary processes, transcending the limitations of static optimization approaches. Comprehensive empirical evaluation across three cryptocurrencies demonstrates systematic and statistically significant performance improvements on both total returns and risk-adjusted metrics.

AI Key Findings

Generated Oct 11, 2025

Methodology

The paper introduces CGA-Agent, a hybrid framework combining genetic algorithms with multi-agent coordination mechanisms for adaptive trading strategy optimization in dynamic cryptocurrency markets. It uses a rolling-window backtesting approach with real-time market data and fitness functions based on metrics like Sharpe Ratio and Sortino Ratio.

Key Results

- CGA-Agent-SS outperformed the baseline strategy across all three cryptocurrencies, achieving higher total returns and improved risk-adjusted metrics.

- The framework demonstrated significant performance improvements, with PnL increases of 29.17% for BTC, 550% for ETH, and 169.48% for BNB.

- Parameter adjustments by CGA-Agent led to enhanced Sharpe Ratios and Sortino Ratios, indicating better risk-adjusted returns across different market conditions.

Significance

This research advances quantitative finance by introducing an adaptive optimization framework that addresses the challenges of volatile and non-stationary cryptocurrency markets. It provides a scalable solution for dynamic strategy optimization with potential applications in other complex financial domains.

Technical Contribution

The paper proposes a novel hybrid optimization system that integrates genetic algorithms with multi-agent coordination, enabling dynamic parameter optimization for trading strategies while incorporating real-time market intelligence and adaptive feedback mechanisms.

Novelty

CGA-Agent uniquely combines genetic algorithms with intelligent multi-agent coordination mechanisms, incorporating real-time market microstructure data and adaptive feedback to guide evolutionary processes, which is a departure from traditional static optimization approaches.

Limitations

- The framework relies on historical data for backtesting, which may not fully capture future market dynamics.

- The computational complexity of multi-agent coordination could limit real-time application scalability.

Future Work

- Exploring integration with real-time market sentiment analysis for enhanced adaptability.

- Investigating the framework's applicability to other financial markets beyond cryptocurrencies.

- Developing more efficient multi-agent coordination mechanisms to reduce computational overhead.

Paper Details

PDF Preview

Similar Papers

Found 4 papersThe Recurrent Reinforcement Learning Crypto Agent

Paolo Barucca, Nick Firoozye, Gabriel Borrageiro

Comments (0)