Summary

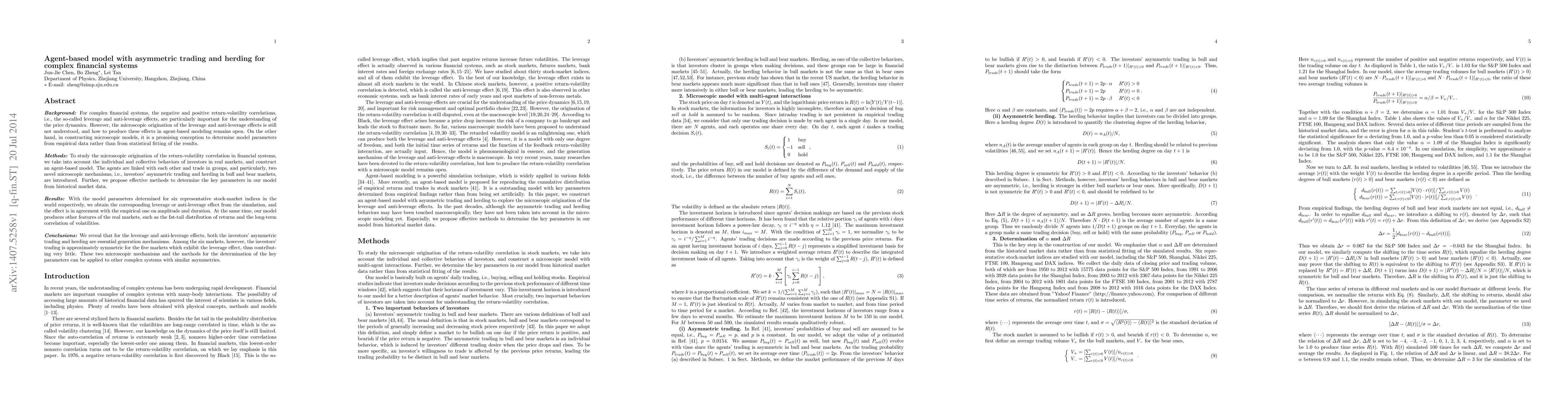

Background: For complex financial systems, the negative and positive return-volatility correlations, i.e., the so-called leverage and anti-leverage effects, are particularly important for the understanding of the price dynamics. However, the microscopic origination of the leverage and anti-leverage effects is still not understood, and how to produce these effects in agent-based modeling remains open. On the other hand, in constructing microscopic models, it is a promising conception to determine model parameters from empirical data rather than from statistical fitting of the results. Methods: To study the microscopic origination of the return-volatility correlation in financial systems, we take into account the individual and collective behaviors of investors in real markets, and construct an agent-based model. The agents are linked with each other and trade in groups, and particularly, two novel microscopic mechanisms, i.e., investors' asymmetric trading and herding in bull and bear markets, are introduced. Further, we propose effective methods to determine the key parameters in our model from historical market data. Results: With the model parameters determined for six representative stock-market indices in the world respectively, we obtain the corresponding leverage or anti-leverage effect from the simulation, and the effect is in agreement with the empirical one on amplitude and duration. At the same time, our model produces other features of the real markets, such as the fat-tail distribution of returns and the long-term correlation of volatilities. Conclusions: We reveal that for the leverage and anti-leverage effects, both the investors' asymmetric trading and herding are essential generation mechanisms. These two microscopic mechanisms and the methods for the determination of the key parameters can be applied to other complex systems with similar asymmetries.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)