Summary

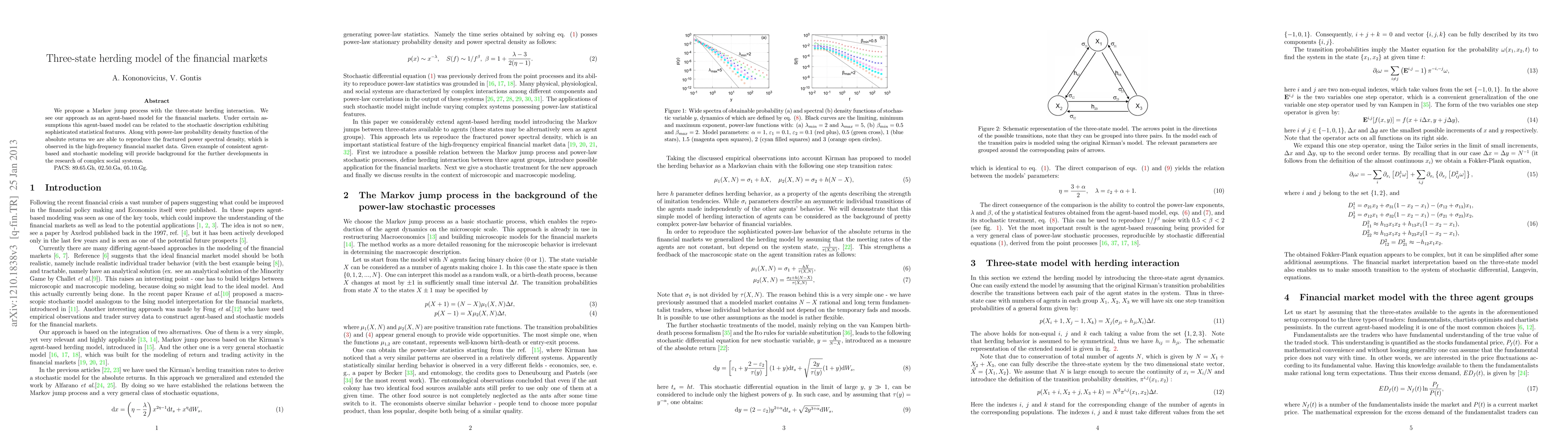

We propose a Markov jump process with the three-state herding interaction. We see our approach as an agent-based model for the financial markets. Under certain assumptions this agent-based model can be related to the stochastic description exhibiting sophisticated statistical features. Along with power-law probability density function of the absolute returns we are able to reproduce the fractured power spectral density, which is observed in the high-frequency financial market data. Given example of consistent agent-based and stochastic modeling will provide background for the further developments in the research of complex social systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)