Summary

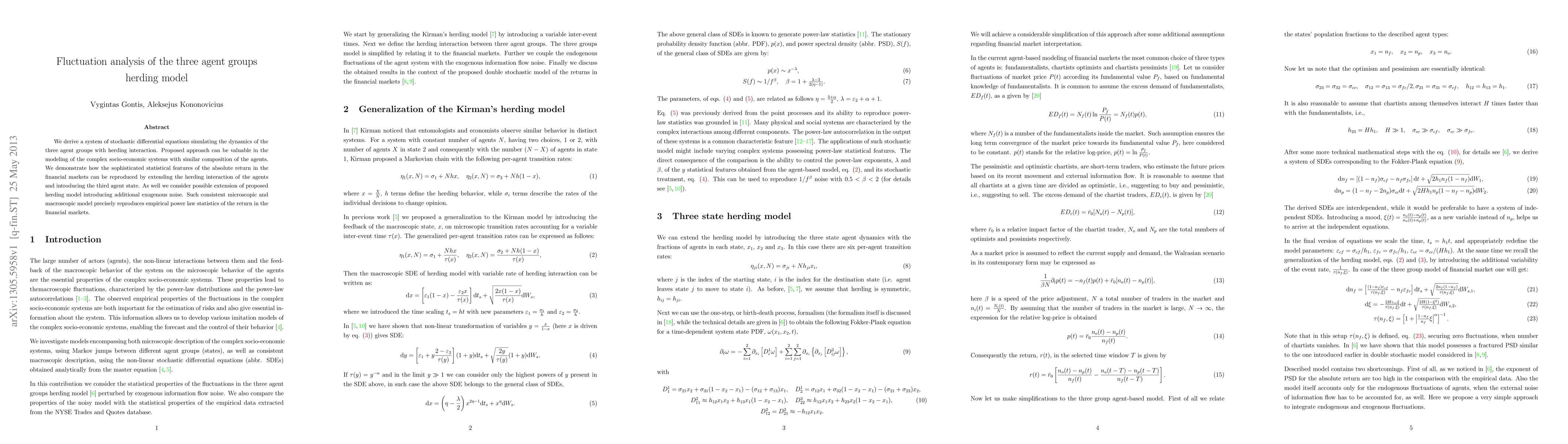

We derive a system of stochastic differential equations simulating the dynamics of the three agent groups with herding interaction. Proposed approach can be valuable in the modeling of the complex socio-economic systems with similar composition of the agents. We demonstrate how the sophisticated statistical features of the absolute return in the financial markets can be reproduced by extending the herding interaction of the agents and introducing the third agent state. As well we consider possible extension of proposed herding model introducing additional exogenous noise. Such consistent microscopic and macroscopic model precisely reproduces empirical power law statistics of the return in the financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)