Authors

Summary

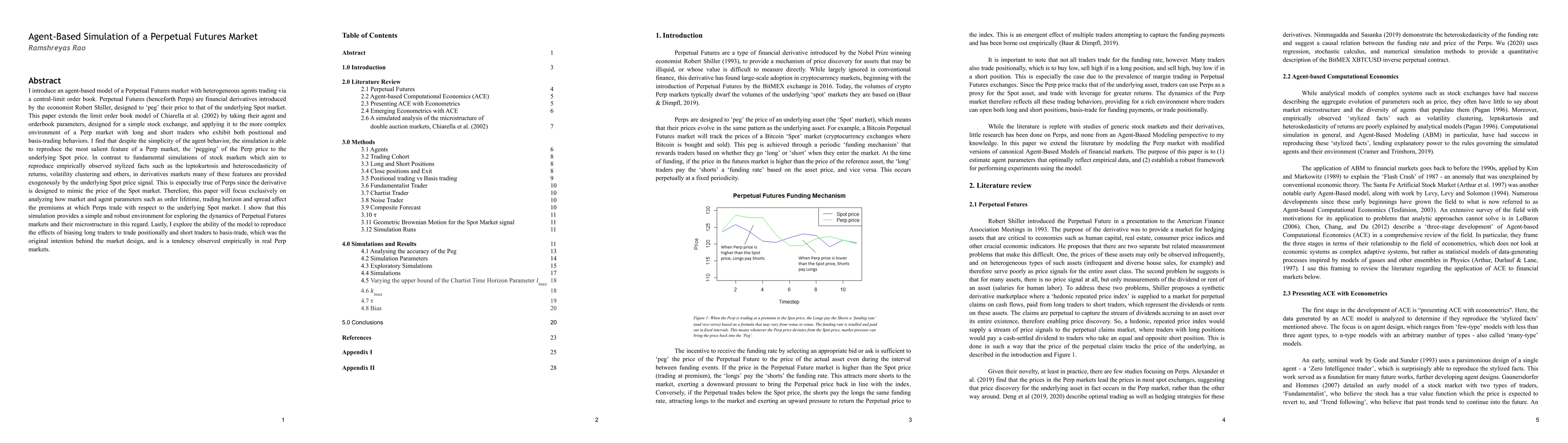

I introduce an agent-based model of a Perpetual Futures market with heterogeneous agents trading via a central limit order book. Perpetual Futures (henceforth Perps) are financial derivatives introduced by the economist Robert Shiller, designed to peg their price to that of the underlying Spot market. This paper extends the limit order book model of Chiarella et al. (2002) by taking their agent and orderbook parameters, designed for a simple stock exchange, and applying it to the more complex environment of a Perp market with long and short traders who exhibit both positional and basis-trading behaviors. I find that despite the simplicity of the agent behavior, the simulation is able to reproduce the most salient feature of a Perp market, the pegging of the Perp price to the underlying Spot price. In contrast to fundamental simulations of stock markets which aim to reproduce empirically observed stylized facts such as the leptokurtosis and heteroscedasticity of returns, volatility clustering and others, in derivatives markets many of these features are provided exogenously by the underlying Spot price signal. This is especially true of Perps since the derivative is designed to mimic the price of the Spot market. Therefore, this paper will focus exclusively on analyzing how market and agent parameters such as order lifetime, trading horizon and spread affect the premiums at which Perps trade with respect to the underlying Spot market. I show that this simulation provides a simple and robust environment for exploring the dynamics of Perpetual Futures markets and their microstructure in this regard. Lastly, I explore the ability of the model to reproduce the effects of biasing long traders to trade positionally and short traders to basis-trade, which was the original intention behind the market design, and is a tendency observed empirically in real Perp markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersAdvanced Digital Simulation for Financial Market Dynamics: A Case of Commodity Futures

Cheng Wang, Changjun Jiang, Chuwen Wang et al.

No citations found for this paper.

Comments (0)