Summary

This study presents an agent-based computational cross-market model for Chinese equity market structure, which includes both stocks and CSI 300 index futures. In this model, we design several stocks and one index futures to simulate this structure. This model allows heterogeneous investors to make investment decisions with restrictions including wealth, market trading mechanism, and risk management. Investors' demands and order submissions are endogenously determined. Our model successfully reproduces several key features of the Chinese financial markets including spot-futures basis distribution, bid-ask spread distribution, volatility clustering and long memory in absolute returns. Our model can be applied in cross-market risk control, market mechanism design and arbitrage strategies analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

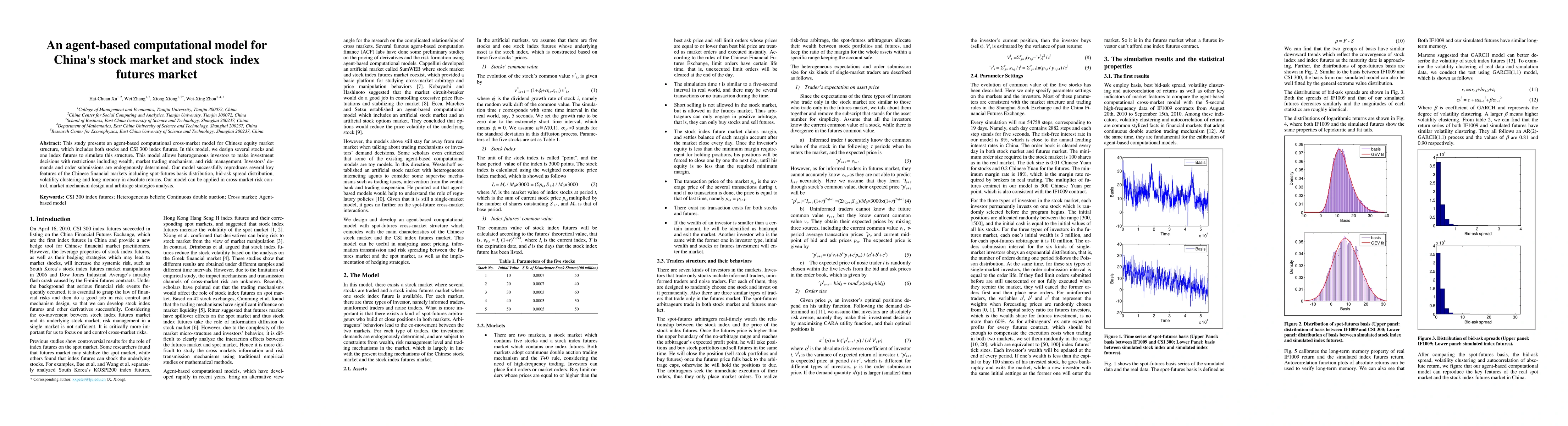

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)