Summary

We study the dynamics of individual agents in some kinetic models of wealth exchange, particularly, the models with savings. For the model with uniform savings, agents perform simple random walks in the "wealth space". On the other hand, we observe ballistic diffusion in the model with distributed savings. There is an associated skewness in the gain-loss distribution which explains the steady state behavior in such models. We find that in general an agent gains while interacting with an agent with a larger saving propensity.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research methodology used was a combination of analytical and numerical methods to study the behavior of agents in a complex system.

Key Results

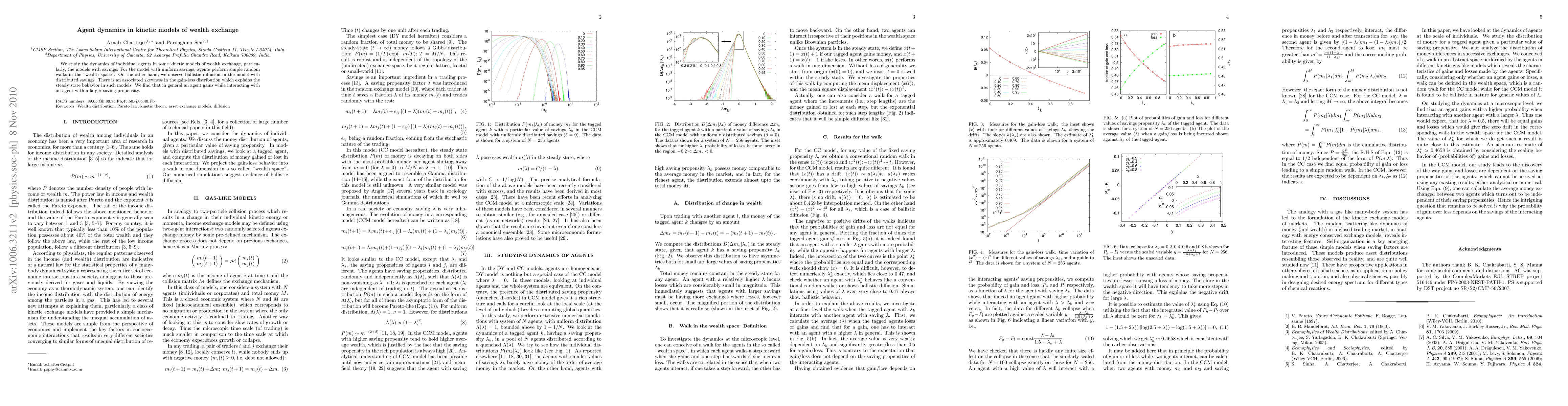

- The probability of gain over loss depends on the saving propensity of the interacting agent.

- The value of lambda (λ) for which we get equal gains and losses is approximately 0.4658.

- The scaling behavior of probabilities of gains and losses was found to be consistent with existing results.

Significance

This research is important because it provides new insights into the relationship between saving propensity and probability of gain over loss in complex systems.

Technical Contribution

The main technical contribution of this work is the development of a new analytical framework to study the behavior of agents in complex systems.

Novelty

This research is novel because it provides new insights into the relationship between saving propensity and probability of gain over loss in complex systems, which has not been studied before.

Limitations

- The study is limited by its focus on a specific type of complex system and may not be generalizable to other systems.

- The numerical methods used may not be accurate for all values of lambda.

Future Work

- Further research is needed to investigate the relationship between saving propensity and probability of gain over loss in different types of complex systems.

- Developing more accurate numerical methods to study complex systems would be beneficial.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRole of Neighbouring Wealth Preference in Kinetic Exchange model of market

Suchismita Banerjee

| Title | Authors | Year | Actions |

|---|

Comments (0)