Summary

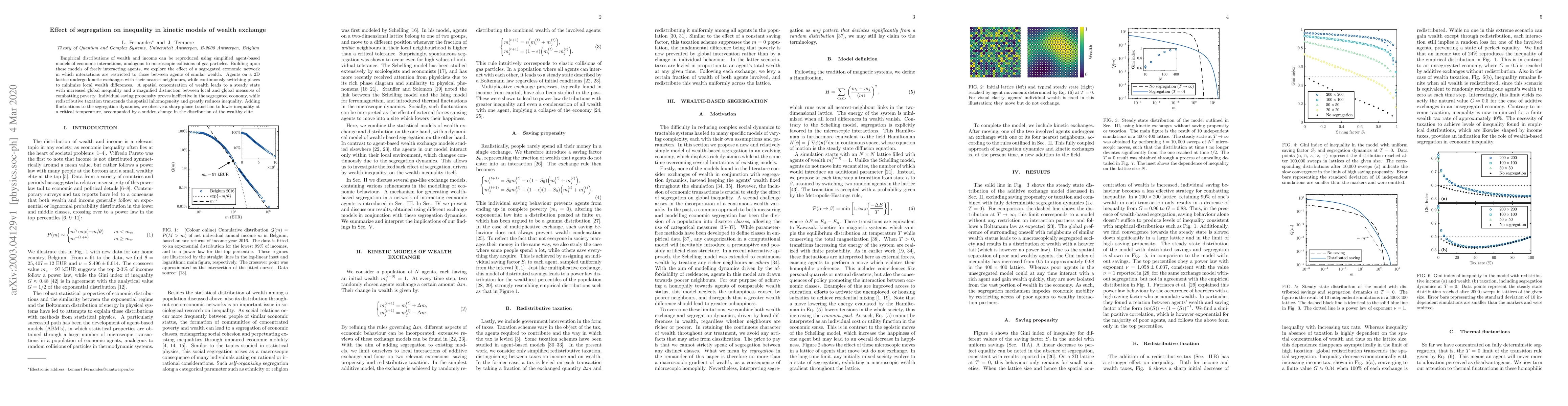

Empirical distributions of wealth and income can be reproduced using simplified agent-based models of economic interactions, analogous to microscopic collisions of gas particles. Building upon these models of freely interacting agents, we explore the effect of a segregated economic network in which interactions are restricted to those between agents of similar wealth. Agents on a 2D lattice undergo kinetic exchanges with their nearest neighbours, while continuously switching places to minimize local wealth differences. A spatial concentration of wealth leads to a steady state with increased global inequality and a magnified distinction between local and global measures of combatting poverty. Individual saving propensity proves ineffective in the segregated economy, while redistributive taxation transcends the spatial inhomogeneity and greatly reduces inequality. Adding fluctuations to the segregation dynamics, we observe a sharp phase transition to lower inequality at a critical temperature, accompanied by a sudden change in the distribution of the wealthy elite.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRole of Neighbouring Wealth Preference in Kinetic Exchange model of market

Suchismita Banerjee

| Title | Authors | Year | Actions |

|---|

Comments (0)