Summary

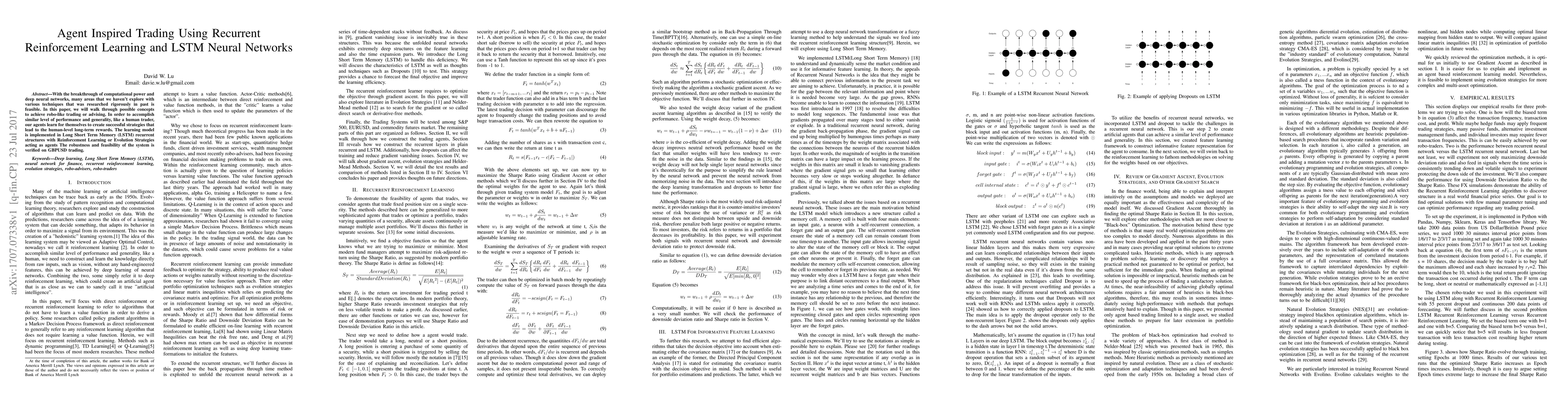

With the breakthrough of computational power and deep neural networks, many areas that we haven't explore with various techniques that was researched rigorously in past is feasible. In this paper, we will walk through possible concepts to achieve robo-like trading or advising. In order to accomplish similar level of performance and generality, like a human trader, our agents learn for themselves to create successful strategies that lead to the human-level long-term rewards. The learning model is implemented in Long Short Term Memory (LSTM) recurrent structures with Reinforcement Learning or Evolution Strategies acting as agents The robustness and feasibility of the system is verified on GBPUSD trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Novel Deep Reinforcement Learning Based Automated Stock Trading System Using Cascaded LSTM Networks

Jie Zou, Jiashu Lou, Baohua Wang et al.

The Recurrent Reinforcement Learning Crypto Agent

Paolo Barucca, Nick Firoozye, Gabriel Borrageiro

Deep Q-Network (DQN) multi-agent reinforcement learning (MARL) for Stock Trading

John Christopher Tidwell, John Storm Tidwell

| Title | Authors | Year | Actions |

|---|

Comments (0)