Summary

Autonomous and learning agents increasingly participate in markets - setting prices, placing bids, ordering inventory. Such agents are not just aiming to optimize in an uncertain environment; they are making decisions in a game-theoretical environment where the decision of one agent influences the profit of other agents. While game theory usually predicts outcomes of strategic interaction as an equilibrium, it does not capture how repeated interaction of learning agents arrives at a certain outcome. This article surveys developments in modeling agent behavior as dynamical systems, with a focus on projected gradient and no-regret learning algorithms. In general, learning in games can lead to all types of dynamics, including convergence to equilibrium, but also cycles and chaotic behavior. It is important to understand when we can expect efficient equilibrium in automated markets and when this is not the case. Thus, we analyze when and how learning agents converge to an equilibrium of a market game, drawing on tools from variational inequalities and Lyapunov stability theory. Special attention is given to the stability of projected dynamics and the convergence to equilibrium sets as limiting outcomes. Overall, the paper provides mathematical foundations for analyzing stability and convergence in agentic markets driven by autonomous, learning agents.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

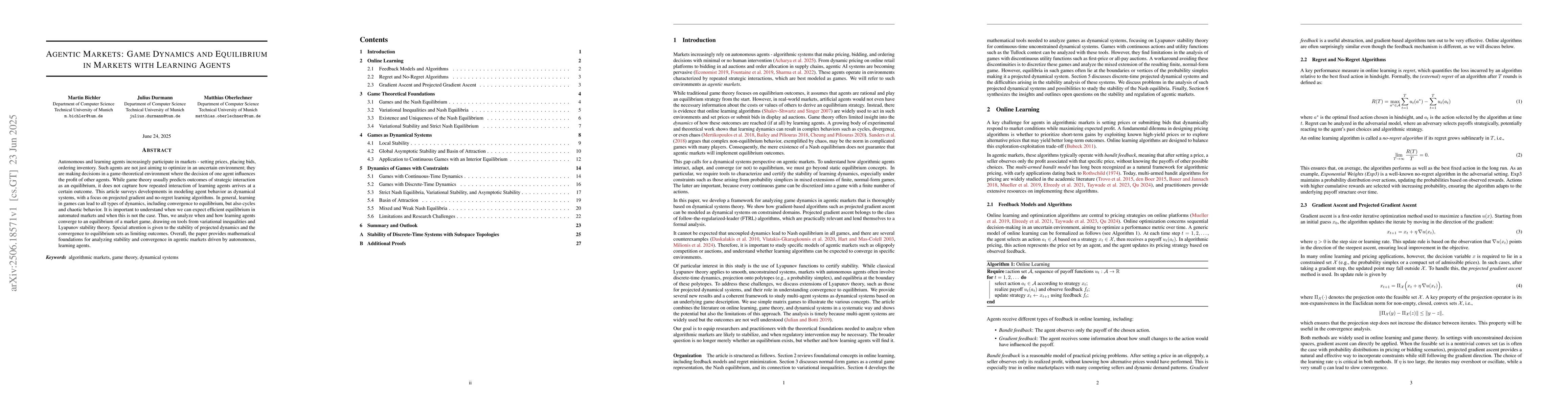

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)