Summary

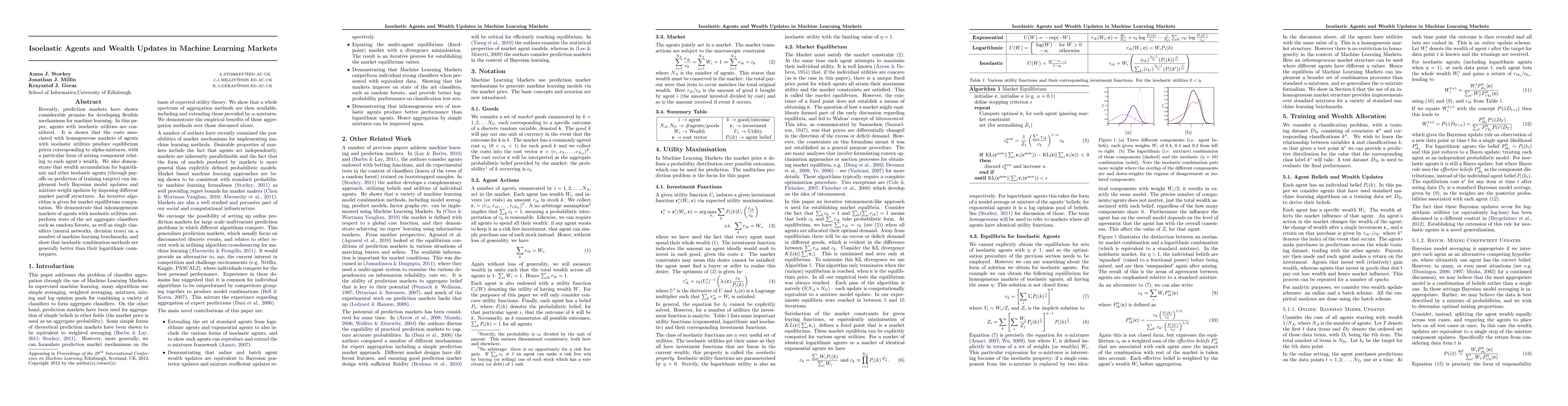

Recently, prediction markets have shown considerable promise for developing flexible mechanisms for machine learning. In this paper, agents with isoelastic utilities are considered. It is shown that the costs associated with homogeneous markets of agents with isoelastic utilities produce equilibrium prices corresponding to alpha-mixtures, with a particular form of mixing component relating to each agent's wealth. We also demonstrate that wealth accumulation for logarithmic and other isoelastic agents (through payoffs on prediction of training targets) can implement both Bayesian model updates and mixture weight updates by imposing different market payoff structures. An iterative algorithm is given for market equilibrium computation. We demonstrate that inhomogeneous markets of agents with isoelastic utilities outperform state of the art aggregate classifiers such as random forests, as well as single classifiers (neural networks, decision trees) on a number of machine learning benchmarks, and show that isoelastic combination methods are generally better than their logarithmic counterparts.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAgentic Markets: Game Dynamics and Equilibrium in Markets with Learning Agents

Martin Bichler, Matthias Oberlechner, Julius Durmann

Learning in Markets with Heterogeneous Agents: Dynamics and Survival of Bayesian vs. No-Regret Learners

Yoav Kolumbus, Eva Tardos, David Easley

| Title | Authors | Year | Actions |

|---|

Comments (0)