Summary

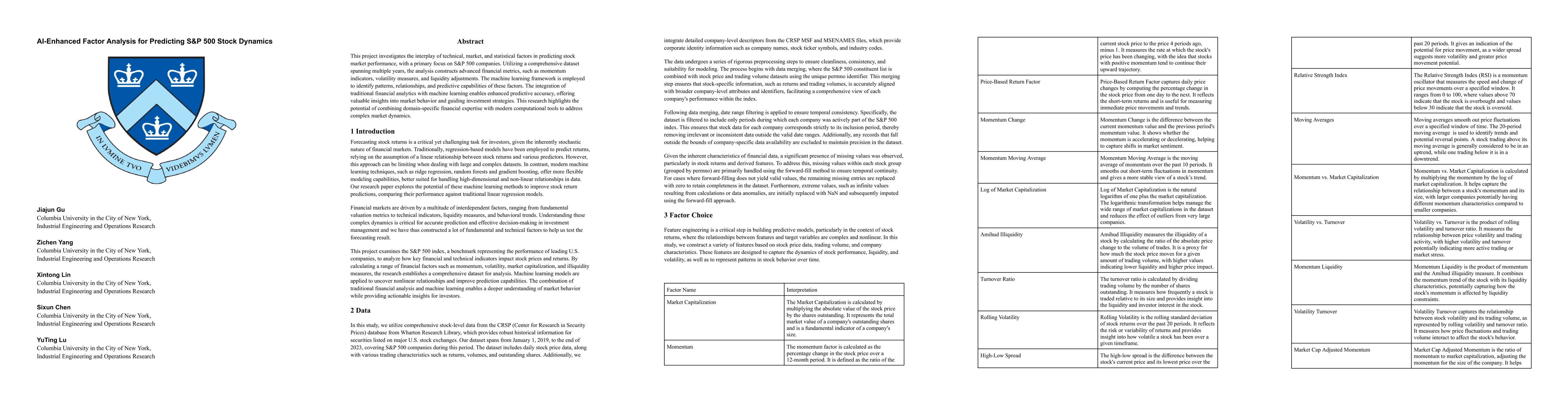

This project investigates the interplay of technical, market, and statistical factors in predicting stock market performance, with a primary focus on S&P 500 companies. Utilizing a comprehensive dataset spanning multiple years, the analysis constructs advanced financial metrics, such as momentum indicators, volatility measures, and liquidity adjustments. The machine learning framework is employed to identify patterns, relationships, and predictive capabilities of these factors. The integration of traditional financial analytics with machine learning enables enhanced predictive accuracy, offering valuable insights into market behavior and guiding investment strategies. This research highlights the potential of combining domain-specific financial expertise with modern computational tools to address complex market dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersS&P 500 Stock Price Prediction Using Technical, Fundamental and Text Data

Shan Zhong, David B. Hitchcock

No citations found for this paper.

Comments (0)