Summary

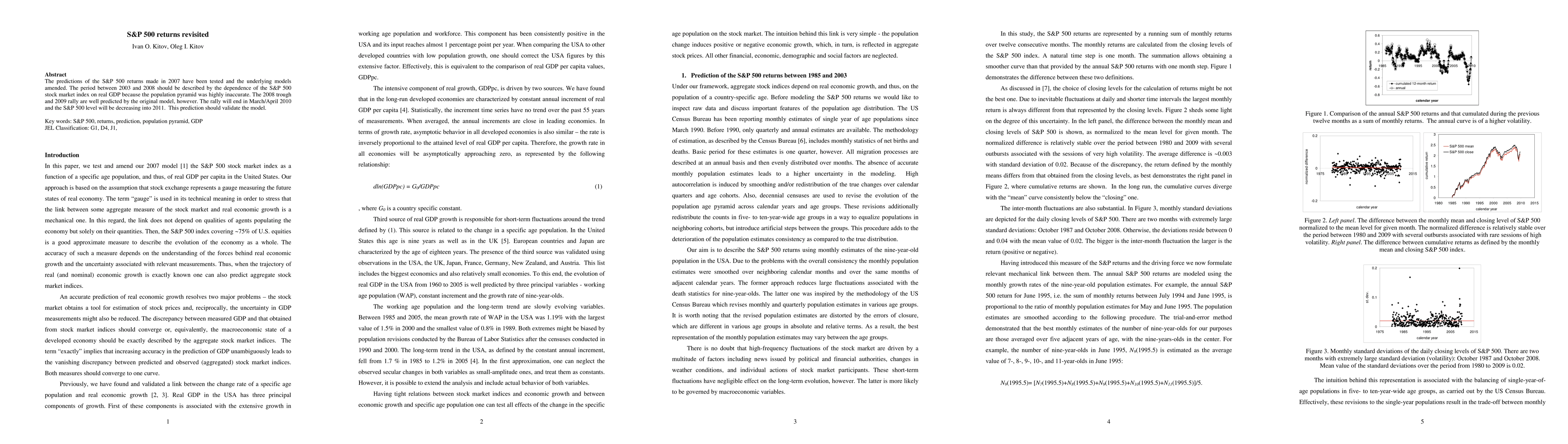

The predictions of the S&P 500 returns made in 2007 have been tested and the underlying models amended. The period between 2003 and 2008 should be described by the dependence of the S&P 500 stock market index on real GDP because the population pyramid was highly inaccurate. The 2008 trough and 2009 rally are well predicted by the original model, however. The rally will end in March/April 2010 and the S&P 500 level will be decreasing into 2011. This prediction should validate the model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)